Zcash Whales Lose Tussle Against Sellers; ZEC Price Faces 55% Crash

Zcash price action has disappointed traders after a widely anticipated breakout failed to materialize. ZEC reversed sharply as broader market conditions deteriorated, erasing bullish momentum.

Rising macro uncertainty shifted sentiment, favoring short positions. This breakdown now benefits bearish traders who positioned for downside after Zcash lost key technical support.

Zcash Whales Tried Their Best

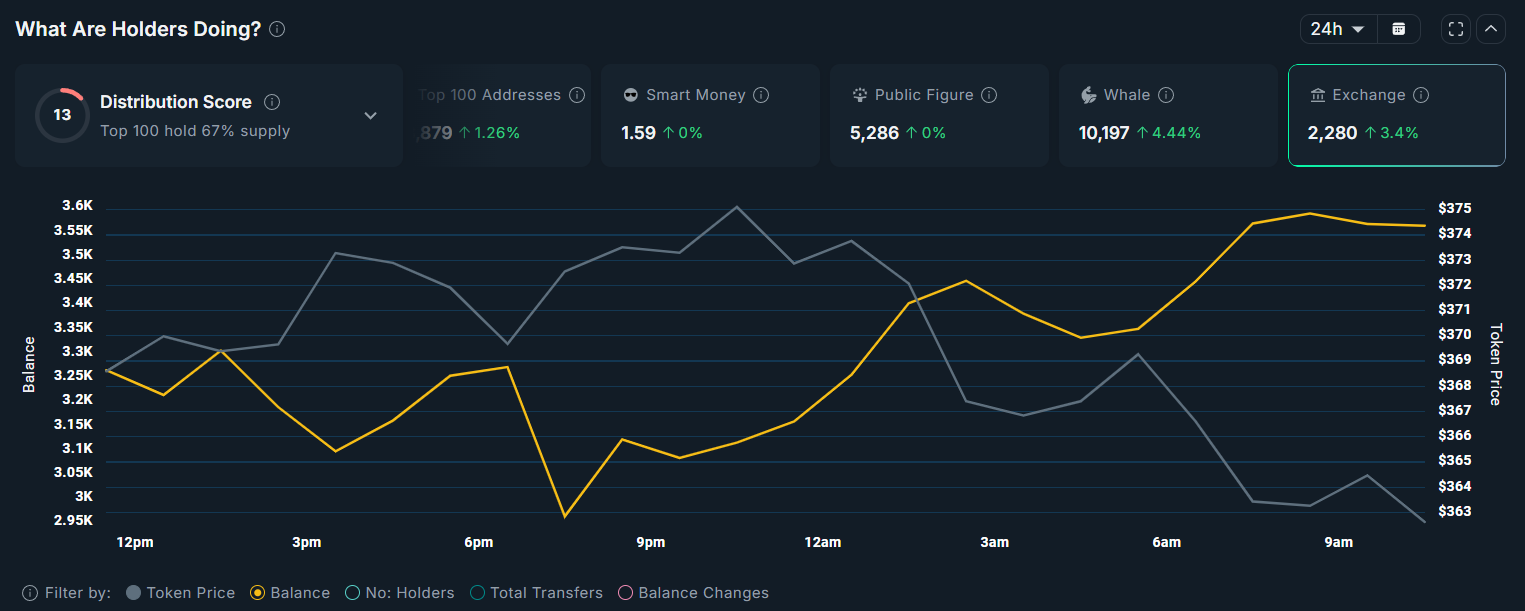

Zcash market sentiment reflects a clear tug-of-war between accumulation and distribution. On-chain data shows whales have attempted to accumulate ZEC over recent days, signaling long-term confidence. However, sellers have matched that activity, steadily offloading tokens while anticipating a deeper price correction.

Exchange balances increased by 3.4% over the past 24 hours, a strong indicator of growing sell-side pressure. Rising balances typically suggest tokens are being moved to exchanges for liquidation. With ZEC now breaking down technically, this selling activity is likely to accelerate, leaving the price increasingly exposed to downside risk.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Long Traders Should Be Under Threat

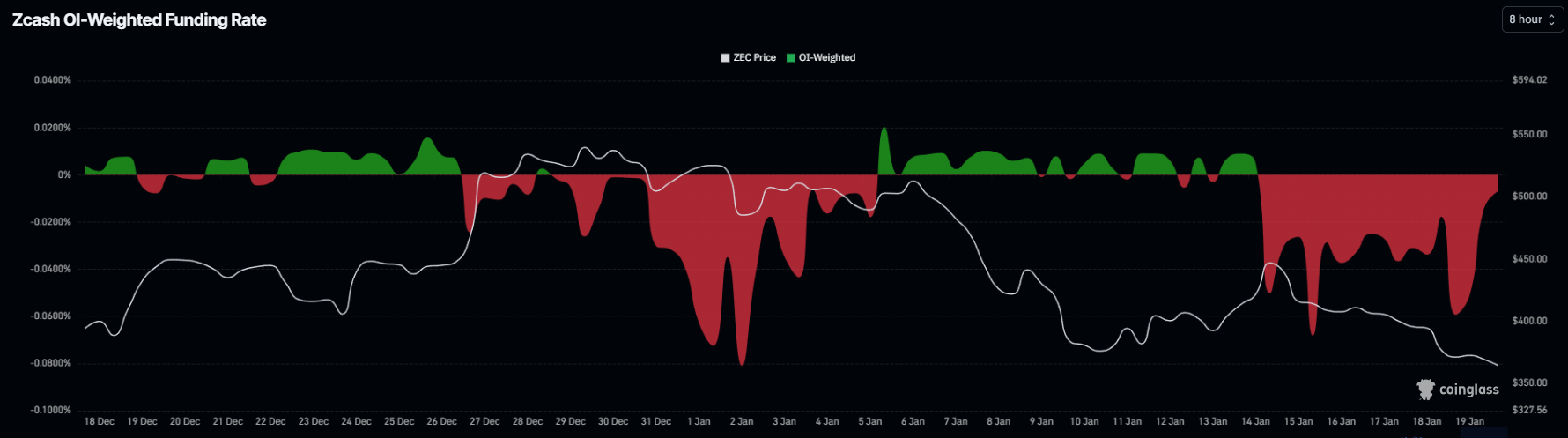

Macro indicators point firmly toward bearish momentum for Zcash. The funding rate for ZEC has remained negative for more than a week, reflecting a market dominated by short positions. Traders have clearly shifted expectations toward further price declines, reinforcing downward pressure.

Negative funding rates signal that short sellers are paying to maintain positions, often during periods of strong bearish conviction. This environment is especially unfavorable for long traders, who face mounting risk as the price fails to recover. Sustained negative funding typically aligns with prolonged downtrends.

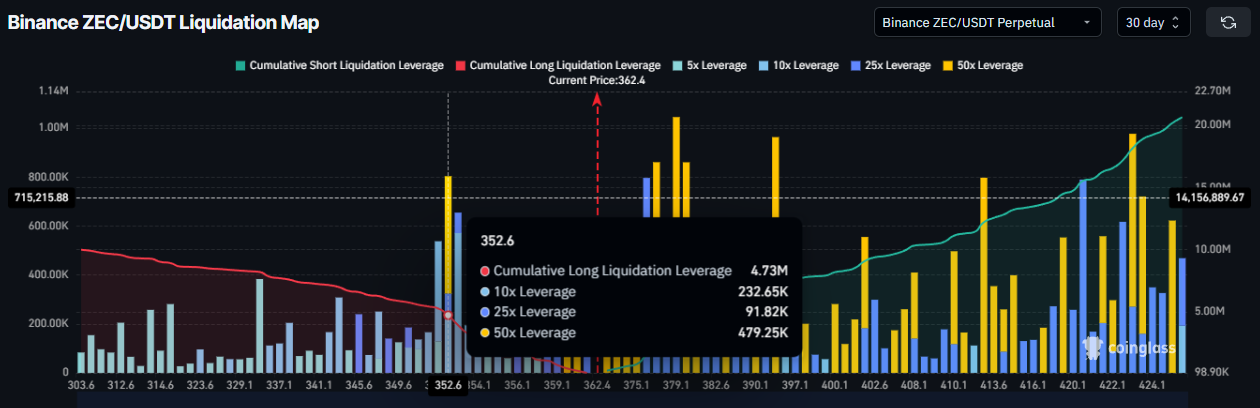

Liquidation data adds to the cautionary outlook. According to the liquidation map, approximately $4.73 million in long positions could be liquidated if ZEC falls to $352. This concentration of risk increases the probability of cascading sell-offs, as forced liquidations amplify volatility and reinforce bearish momentum.

ZEC Price Could Bounce Back

ZEC trades near $363 at the time of writing after breaking down from a triangle pattern. Earlier price action suggested a potential breakout, but worsening macro sentiment reversed that setup. The breakdown projects a steep 55% decline, placing the technical downside target near $171.

If the bearish scenario plays out, Zcash could first slide toward the $340 support level. Losing that zone would likely accelerate selling pressure. A breakdown there could push ZEC toward $300, with extended downside exposing the $256 level as a secondary support.

Despite current weakness, the privacy coin narrative remains intact. If bulls regain control, ZEC could stabilize above $340 and rebound. A recovery toward $405 would invalidate the bearish thesis, signaling renewed demand and shifting momentum back in favor of buyers.

The post Zcash Whales Lose Tussle Against Sellers; ZEC Price Faces 55% Crash appeared first on BeInCrypto.

Read more