XRP Price Needs to Replicate This Four-Month-Old Move to Get a 33% Rally ‘Moving’

XRP has been one of the weaker large-cap tokens this week. The XRP price is down about 6% over the past seven days, putting pressure on short-term sentiment.

Still, the latest pullback may not be the end of the move. The chart and on-chain data suggest XRP is sitting at a make-or-break moment that depends on whether it can repeat a setup last seen four months ago.

Price Chart Shows a Familiar Setup

XRP appears to be forming an inverse head-and-shoulders structure on the daily chart. This pattern often signals a trend reversal, but only if key levels are reclaimed. Right now, the neckline of the structure sits near $2.52, around 28% above current prices.

For that rally path to open, XRP first needs to reclaim the 100-day exponential moving average (EMA), the sky blue line. An EMA gives more weight to recent prices, so it reacts faster to trend changes than a simple moving average. Historically, this level has acted as a major decision point for XRP. In September, reclaiming the 100-day EMA led to a roughly 12% rally. Earlier that same month, a similar reclaim produced a 16% move higher.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

So far, XRP has failed to hold above shorter-term EMAs (20-day and 50-day) and was rejected again near the 100-day EMA on January 14. Still, the latest sell-off printed a long lower wick, showing buyers quickly absorbed downside pressure. That response suggests demand is present, keeping the bullish structure alive for now, but only if the EMA barrier is eventually reclaimed.

Whales and Holders Position Early, but Spot Buying Alone May Not Be Enough

On-chain data shows early positioning beneath the surface. Whales holding 10 million to 100 million XRP increased balances from roughly 11.14 billion to 11.17 billion tokens, worth roughly $60 million at current prices.

Smaller whales holding 1 million to 10 million XRP were even more active. Their balances rose from around 3.54 billion to 3.59 billion XRP, or nearly $100 million. These additions began around January 14, ahead of broader holder accumulation. While they dumped a few tokens on January 15 as the XRP price started correcting, the net positioning since January 14 still remains positive.

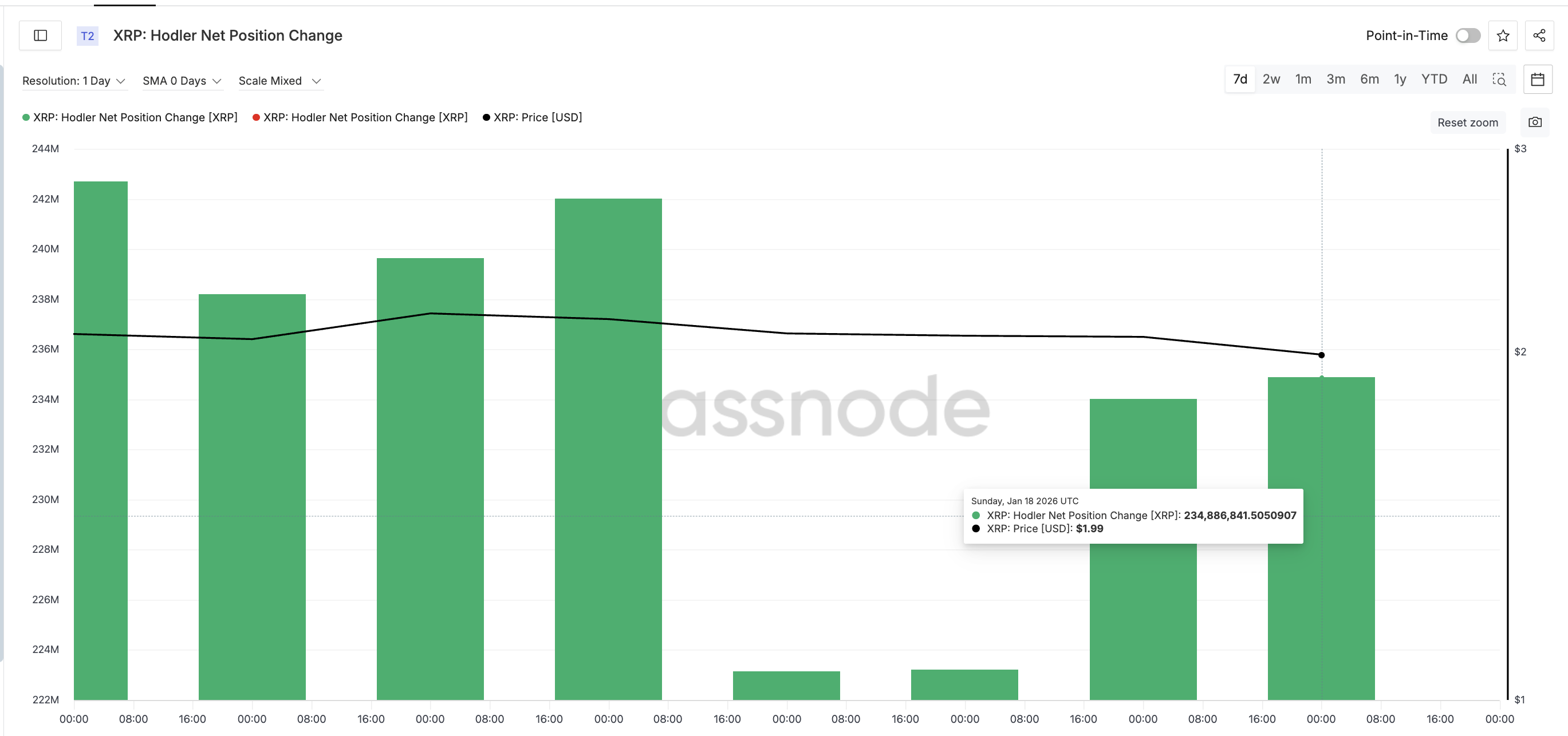

Holders followed the whales. Since January 16, the long-term holder net position change has turned decisively positive. This metric tracks wallets holding XRP for roughly 155 days or more, making it a useful proxy for conviction-based holders rather than short-term traders.

On January 16, this cohort held approximately 223,201,195 XRP. By January 18, holdings had risen to about 234,886,841 XRP. That is an increase of roughly 11.69 million XRP, representing a 5.2% rise in holdings over just two days.

The timing matters. Whales began positioning earlier, during the initial correction, while long-term holders stepped in after January 16. This staggered accumulation suggests deliberate buying rather than emotional dip-chasing.

Derivatives Skew Sets Up the Catalyst, While XRP Price Levels Decide the Outcome

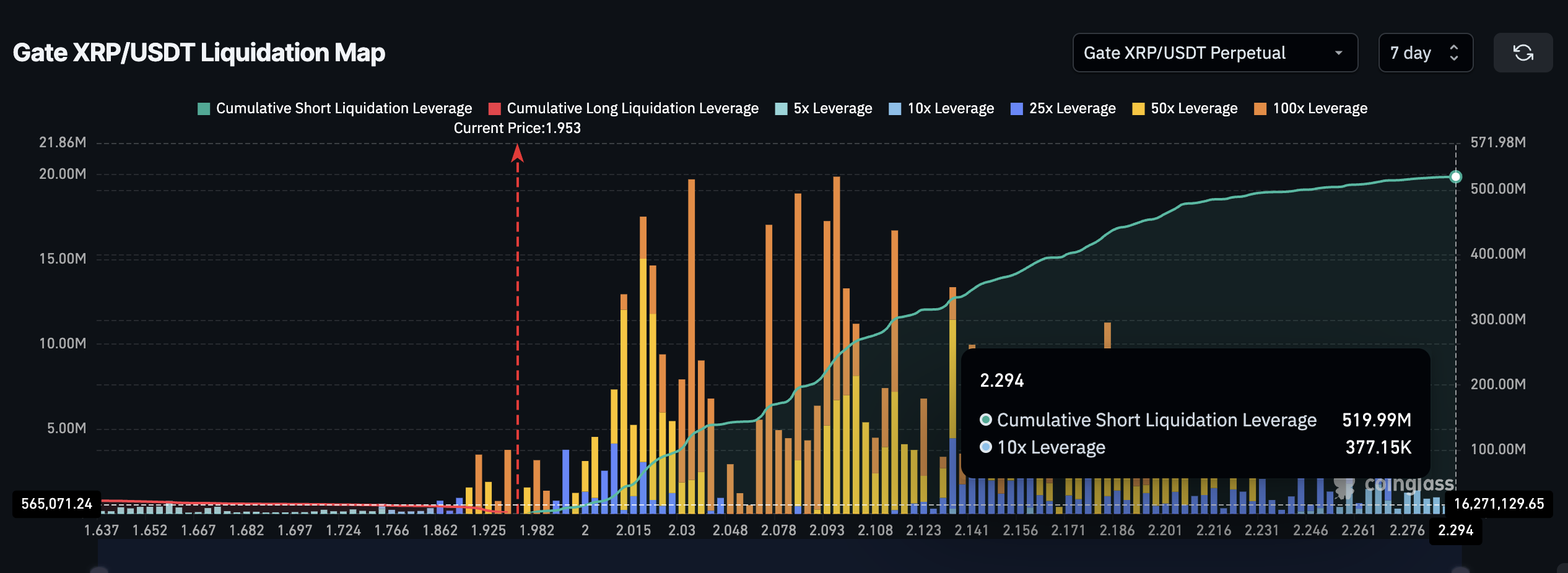

Derivatives positioning adds a key twist. On XRP perpetual markets, short liquidation leverage sits near $520 million, while long leverage is closer to $22 million. That means positioning is skewed over 95% toward shorts.

This imbalance creates fuel. A modest upside move could trigger a short squeeze, amplifying price strength quickly if key levels break.

The levels are clear. XRP needs to close above $2.24 to confirm strength and reclaim the 100-day EMA line. It can then push into the $2.48–$2.52 zone to activate the pattern. If that happens, a 33% rally projection comes back into play.

On the downside, losing $1.84 weakens the setup, while a drop below $1.77 invalidates it entirely. For now, XRP is not breaking out. But if it can replicate the September move, the rally may finally get moving.

The post XRP Price Needs to Replicate This Four-Month-Old Move to Get a 33% Rally ‘Moving’ appeared first on BeInCrypto.

Read more