Top Crypto News This Week: Jupiter Mobile V2, EigenLayer Slashing Upgrade, $332 Million TRUMP Unlocks, and More

This week, several top crypto news events are in the lineup, with stories spanning various ecosystems and having price implications for concerned tokens. From Jupiter and Orca decentralized exchanges (DEX) to PolitiFi meme coin TRUMP, multiple developments are already in the pipeline.

The following roundup gives traders and investors the first-mover advantage to capitalize on the volatility around these events.

Jupiter Mobile V2 and Product Launches

Jupiter, a Solana-based decentralized exchange aggregator, is set to announce multiple product launches this week, with the spotlight on Jupiter Mobile v2.

This upgraded mobile application aims to enhance user experience (UX) with a more intuitive interface, faster transaction processing, and seamless access to Jupiter’s liquidity aggregation tools.

The Jupiter mobile V2 release is expected to include advanced features like improved token swap routing, real-time market data, and enhanced wallet integration. These features would cater to both novice and experienced traders.

Jupiter’s focus on mobile accessibility aligns with its mission to make DeFi more inclusive, potentially driving higher user options. The new product suite may also introduce governance enhancements for the JUP token, strengthening community participation in the Jupiter DAO.

Ahead of this development, Jupiter’s JUP token traded for $0.39, down by almost 2% in the last 24 hours.

Nevertheless, with Solana’s high-speed, low-cost blockchain as its backbone, Jupiter Mobile v2 could set a new standard for DeFi mobile platforms. Specifically, it could boost trading volume and ecosystem engagement.

These launches reflect Jupiter’s commitment to innovation and its role as a key player in Solana’s DeFi playing field, positioning it to compete with top aggregators like Uniswap.

EigenLayer Slashing Upgrade

EigenLayer, an Ethereum-based restaking protocol, is also among this week’s top crypto news. The network will activate its Slashing Upgrade on Thursday, April 17, introducing a critical mechanism to penalize validators who act maliciously or fail to meet performance standards.

“Protocol-complete become reality on April 17th with the launch of Slashing on EigenLayer,” the network shared recently.

The move would enhance the protocol’s security and reliability. Slashing ensures that staked assets are protected by discouraging behaviors like double-signing or downtime, which could undermine trust in EigenLayer’s restaking ecosystem.

The upgrade could also bolster confidence among users who delegate their Ethereum (ETH) to operators, as it aligns incentives for honest participation.

The Slashing Upgrade may also refine EigenLayer’s risk management framework, potentially attracting more institutional interest in restaking.

By strengthening its infrastructure, EigenLayer aims to maintain its edge in competitive staking, where protocols like Lido and Rocket Pool also vie for dominance.

Community discussions on X highlight anticipation for improved stability, though some users speculate about short-term volatility in EIGEN token prices due to market reactions.

As of this writing, EigenLayer’s powering token, EIGEN, was trading for $0.82. This represents a drop of over 2% in the last 24 hours.

Notwithstanding, this upgrade marks a pivotal step in EigenLayer’s evolution, reinforcing its role in Ethereum’s scaling and decentralization efforts.

Fluid Dynamic Fees Implementation

The Fluid ecosystem is also among the top crypto news stories this week. The emerging decentralized exchange is rolling out its dynamic fees implementation this week, a move expected to optimize trading efficiency and boost platform activity.

“Lending, borrowing, and earning trading fees — all in one move? That is what Fluid is unlocking. No idle assets. No missed opportunities. Just pure DeFi efficiency,” noted one user in a post.

Unlike static fee models, dynamic fees adjust in real-time based on market conditions, volatility, and li uidity. This ensures fairer pricing for traders and incentivizes liquidity providers.

This system reduces slippage and enhances capital efficiency, making Fluid more competitive against established DEXs like Uniswap and Curve.

“… the ETH/USDC pool on Fluid has generated about the same fees as the Uniswap pool. This happened because we analyzed LP performance across different fee tiers over the years, and the data showed that the 0.05% fee tier was too low for this pair. We’re planning to roll out dynamic fees soon, but in the meantime, we’ve increased the fee to 0.1%. As a result, volumes dipped slightly, but fees increased significantly. With dynamic fees, we expect to capture even more volume and generate even more fees,” wrote Fluid COO DMH in a recent post.

The implementation could attract a broader user base by offering cost-effective trades during low-volatility periods while maintaining stability during market spikes.

However, the success of this rollout will depend on seamless execution and user adoption, as overly complex fee adjustments could deter retail traders.

KernelDAO Token Launch and S1 Airdrop

Also on the leaderboard in this week’s top crypto news is KernelDAO, the project behind K DAO. It is launching its KERNEL token today, April 14, accompanied by the Season 1 (S1) airdrop.

This crypto airdrop targets early supporters and community contributors. The token serves as the backbone of KernelDAO’s decentralized ecosystem, enabling governance and incentive participation in its data storage and computation network.

The S1 airdrop rewards users who earned Kernel Points or Kelp Grand Miles before December 3, 2024. Those meeting the 150-point threshold receive a minimum of 100 KERNEL per eligible wallet.

This launch aims to distribute 10% of the total token supply, fostering widespread adoption and community engagement.

KernelDAO’s focus on decentralized infrastructure positions it as a competitor to projects like Filecoin (FIL) and Arweave (ARV).

$332 Million Worth TRUMP Unlocks

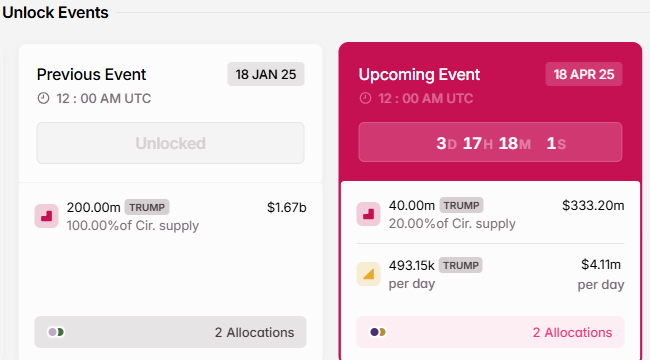

To add to the list, $332 million worth of TRUMP tokens will be unlocked this week, introducing significant liquidity to the market. Specifically, on Friday, April 18, the network will unlock 40 million TRUMP tokens, constituting 20% of its circulating supply.

The tokens will be allocated to creators and CIC Digital 1, an affiliate of the Trump Organization that controls a significant portion of TRUMP tokens.

Token unlocks often lead to price volatility as newly available tokens enter circulation, potentially prompting sell-offs by early investors or speculators.

While the TRUMP unlock could fuel short-term price swings, it may also provide opportunities for new investors to enter at adjusted valuations.

Voting Closes for Orca’s 25% Supply Burn

Orca, a Solana-based DEX, is also among the top crypto news stories this week. Voting on the proposal to burn 25% of its total token supply concludes today.

“We’re now in the final stretch. Your vote can be the one that seals the future of ORCA staking, rewards & protocol growth. Vote before 10:45 am ET April 14,” the network shared.

The project aims to reduce its token supply to increase scarcity, potentially supporting long-term price appreciation and rewarding loyal holders.

Token burns are a common DeFi strategy to align incentives. However, they also carry risks if not paired with ecosystem growth.

The proposal has sparked lively bate. Supporters argue it strengthens Orca’s value proposition against competitors like Raydiu (RAY). Meanwhile, critics warn of reduced liquidity for trading pairs.

If approved, the burn could enhance Orca’s appeal to investors seeking sustainable DeFi projects. However, its success will depend on Orca’s ability to maintain high trading volume and innovate with features like concentrated liquidity pools.

The vote’s outcome will signal Orca’s strategic direction and influence sentiment across Solana’s DeFi ecosystem.

“Onchain governance is happening,” Solana blockchain’s X account quipped.

The post Top Crypto News This Week: Jupiter Mobile V2, EigenLayer Slashing Upgrade, $332 Million TRUMP Unlocks, and More appeared first on BeInCrypto.

Read more