Top Crypto News This Week: $1.9 Billion Solana Unlock, Nvidia Earnings, ETHDenver, and More

This week in crypto, several major events are set to capture the attention of industry participants. Among the top stories include a massive Solana unlock, the debut of Aave on Sonic Layer-1 (L1), and the KernelDAO token launch.

Each of these events promises significant developments across their respective ecosystems. They offer insights and potential growth opportunities, which forward-looking traders and investors are likely to capitalize on.

$1.9 Billion Solana Unlock

This week’s key highlight is the unlocking of $1.9 billion worth of Solana (SOL) on March 1. Specifically, roughly 11.2 million SOL tokens will be released, representing about 2.2% of Solana’s current circulating supply (around 488 million SOL).

This event is tied to the FTX bankruptcy estate. The tokens stem from FTX’s liquidation process, where the bankrupt exchange previously sold locked SOL at discounted rates of around $64 to $102 per token to big players like Galaxy Digital, Pantera Capital, and others.

As of this writing, SOL is trading for around $158.91, so these institutional buyers are sitting on hefty unrealized profits. The unlock happens this Saturday, and the big question is whether they will hold or sell.

A mass sell-off could flood the market, potentially tanking SOL’s price due to increased supply outpacing demand. However, the impact might be muted if they hold, especially if Solana’s ecosystem keeps growing. Nevertheless, market sentiment is already jittery, with posts on X showing retail investors selling off SOL in anticipation, fearing a dip.

“While the team’s, seed investors’, and foundation’s shares are locked (also about 40%), the release of such a large volume poses a risk of market shock,” a popular account on X stated.

Technicals are not rosy either as Solana buyers retreat. Notwithstanding, SOL fundamentals like its fast, low-cost blockchain and rising adoption could cushion the blow long-term. Similarly, past unlocks, like the 7x supply increase in 2020, actually kicked off a bull run, though the market was less mature then.

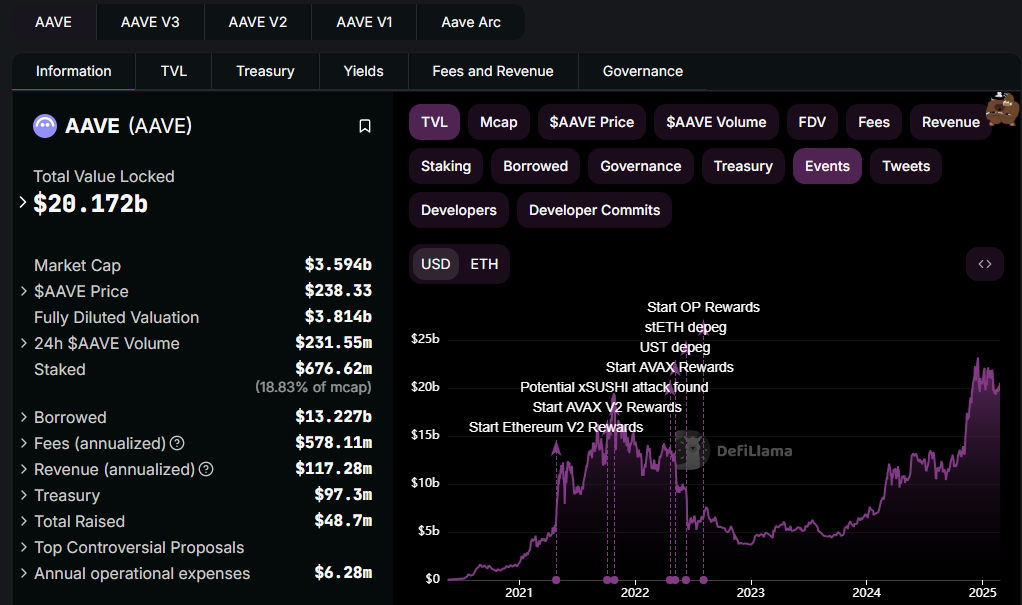

Aave Debuting on Sonic L1

In December, Sonic Labs indicated the Aave governance process to bring the $22 billion lending market to Sonic. This week in crypto, Aave is going live on Sonic. This marks a major development, given that Aava dominates the DeFi lending market with $20 billion in total value locked (TVL), according to DefiLlama data.

Launching on the L1 would allow Sonic users to tap on-chain native credit lines and offer liquidity to other investors. Sonic’s high transaction speed and fee-sharing model could also prove to be major incentives for Aave’s deployment on the network.

“AAVE will be the tangible breakthrough for Sonic that gets it from “small but promising chain” to full-fledged powerhouse. The network effect of AAVE is immense. And on Sonic that effect will be galvanized by the existing landscape,” popular user Jack the Oiler observed.

This partnership will also mean a $63 million liquidity commitment, including monetary contributions from various sources. Specifically, the Sonic Foundation pledged $15 million, with an additional $20 million promised in Circles USD Coin (USDC).

The funding would also include up to 50 million S tokens from Sonic, while Aave would contribute $800,000 in stablecoins. This sizable liquidity commitment would secure the financial backbone for Aave’s introduction to the Sonic network.

Nvidia Earnings

Nvidia’s earnings report will also be on the crypto watchlist this week. Nvidia’s fiscal fourth quarter (Q4) report, ending January 2025, is to be released this Wednesday, February 26. The report will be out after the market closes, making it a focal point for investors this week.

As the world’s top chipmaker by market cap, Nvidia’s results are a bellwether for the artificial intelligence boom, meaning impact on AI coins.

“NVDA 1D update-bearish AI news dropping this week…you won’t catch me buying any AI coins when I see the NVDA chart looking that way. I’ve always felt that way about AI coins bc NVDA has been ready to pop since November. All it took was some fake Deep Seek news for the initial distro and then AI memes did -95% of that,” an analyst shared in a post.

KernelDAO Token Launch

Also, this week in crypto, the launch of KernelDAO’s KERNEL token is expected. In a recent blog, KernelDAO said KERNEL would also be the native token of Kelp DAO, a popular liquid restaking protocol.

“The KERNEL token distribution emphasizes community-first principles, allocating the majority of tokens to the users and ecosystem participants,” the network shared.

KERNEL holders could actively participate in decision-making processes for major network products like Kelp LRT, Kernel Infrastructure, and Gain. Governance decisions can include protocol upgrades, fund allocations, and new partnerships.

It would also have a restaking function to provide shared economic security for the Kernel ecosystem, middleware, and decentralized applications (dApps). Further, KERNEL token holders can earn staking rewards from partner protocols and middleware.

Stacks Increase sBTC Deposit Cap

Stacks will increase the deposit cap for sBTC, its yield-bearing, Bitcoin-backed token, on Tuesday, February 25. This move marks a significant step in its mission to activate Bitcoin’s economy.

The sBTC token is a 1:1 Bitcoin-backed asset on the Stacks Layer-2 blockchain. It is designed to bring programmability and DeFi capabilities to BTC while maintaining its security through 100% hash power finality.

Launched on the mainnet in December 2024 with an initial cap of 1,000 BTC, that limit was hit fast—within two days—showing strong demand. This second cap, dubbed “Cap-2,” will add 2,000 more BTC, raising the total to 3,000 BTC available for minting.

“Hold sBTC, Earn Bitcoin. sBTC Cap-2 → Feb 25. Max 3,000 BTC Step 1. Put your BTC to work. Earn 5% APY in real Bitcoin rewards just by holding sBTC. Step 2. Deploy sBTC in DeFi apps for extra yield. Check thread for BTCFi,” Stacks shared recently.

Deposits open on February 25 at 10 a.m. ET on a first-come, first-served basis, with a minimum deposit of 0.01 BTC. sBTC lets BTC holders earn yield without giving up custody or relying on intermediaries, a big shift from wrapped BTC models.

ETHDenver Conference

The ETHDenver conference starts its main event on Thursday, February 27, in Denver, Colorado. Based on social media chatter, it is already shaping to be a pivotal moment for the Ethereum ecosystem.

Billed as the world’s largest and longest-running Ethereum-focused event, it draws thousands of developers, entrepreneurs, and blockchain enthusiasts. During the same event in 2024, over 15,000 attendees came from 115 countries. The expectation is that Ethereum projects could drop major updates, leveraging the event as a launchpad.

“Some analysts believe this event could positively impact Ethereum’s price, as the reduced market supply might lead to a price increase,” a user on X quipped.

The post Top Crypto News This Week: $1.9 Billion Solana Unlock, Nvidia Earnings, ETHDenver, and More appeared first on BeInCrypto.

Read more