Top 5 Made In USA Cryptos To Watch In the Last Week of February

Story, Ondo Finance (ONDO), OFFICIAL TRUMP, Solana (SOL), and Uniswap (UNI) are five Made in USA cryptos to watch closely in the last week of February. Story has gained massive attention as a top AI crypto, despite a recent short-term correction.

ONDO continues to lead in the Real-World Assets sector but faces downward pressure, while TRUMP hovers near all-time lows with high volatility due to news sensitivity. Meanwhile, SOL struggles after a sharp decline, and UNI shows potential for a breakout with the launch of Unichain, sparking renewed interest.

Story (IP)

Story has quickly become one of the most successful Made in USA cryptos recently launched, securing a spot in the top 10 artificial intelligence cryptos within its first days.

Story’s market cap is around $1 billion, and its price has risen nearly 160% in the last seven days, showing strong bullish momentum. However, it’s been down more than 6% in the last 24 hours, suggesting a short-term correction as investors take profits.

If this correction continues, Story (IP) could test the support at $3.65, and losing this level could lead to a drop to $2.12. Conversely, if momentum recovers, it could challenge the resistance at $5.32 and, if broken, target $5.88 next.

Ondo Finance (ONDO)

ONDO remains one of the most relevant and largest players in the Real-World Assets (RWA) sector, maintaining its strong presence despite recent price declines.

Its market cap is currently at $3.55 billion, but the price has corrected by over 25% in the last 30 days.

If the current downtrend continues, ONDO could test the support at $1.09, and losing this level could push the price down to $1. However, if ONDO manages to reverse this trend, it could challenge the resistance at $1.25.

Breaking this resistance could lead to a rise to $1.44, and if the uptrend gains strong momentum, ONDO could test $1.66. This would mark the first time ONDO goes above $1.5 since the end of January, signaling a potential bullish breakout.

OFFICIAL TRUMP (TRUMP)

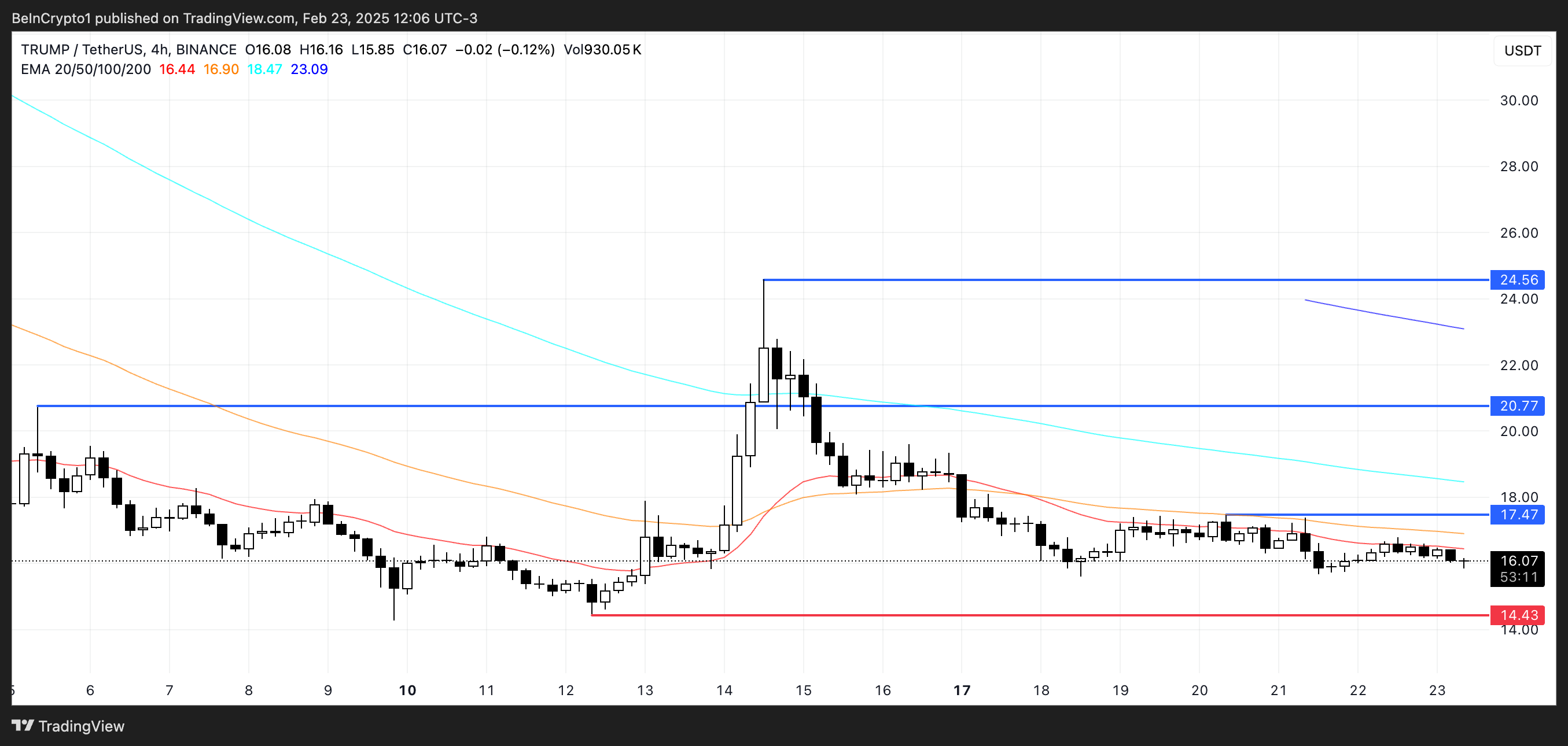

TRUMP, the most hyped meme coin ever launched, is now trading close to all-time lows, staying below $20 since February 15. After reaching highs above $70 in its early days, TRUMP is now hovering around $16, reflecting a significant decline.

Donald Trump’s unpredictable nature makes TRUMP coin highly sensitive to news or statements related to him. Any impactful news could trigger sudden price movements.

If TRUMP can regain positive momentum, it could test the $17.4 resistance, with the potential to rise to $20.7 or even $24.5 if broken. However, if the downtrend continues, it could test support at $14.4 and possibly fall below $10 for the first time since its launch.

Solana (SOL)

SOL has faced significant selling pressure in recent weeks, dropping over 36% in the last 30 days. It has fallen from $268 to around $170 and has remained below $200 since February 15, reflecting a sharp correction.

Despite this downturn, Solana remains a leader across various metrics, including coins launched, trading volume, and dex trades. However, growing concerns about the chain’s extractive ecosystem have sparked debate among users. Sentiment worsened following the launch of the LIBRA meme coin, adding further uncertainty to SOL’s outlook.

If SOL can regain upward momentum, it could test the $180 resistance, and breaking through this level could lead to $188. A strong uptrend would be needed to challenge $205.

Conversely, if selling pressure continues, SOL could test the support at $160, risking further downside.

Uniswap (UNI)

Uniswap remains one of the most influential DeFi applications, and the recent launch of Unichain could attract a new wave of users and capital. UNI has also been one of the most important altcoins in the DEX ecosystem for years.

If UNI can establish an uptrend, it could test the resistance at $9.68, with the potential to reach $10.24 if momentum continues. A strong rally could push UNI to $12.8, its highest level since February 1, signaling renewed bullish sentiment.

However, UNI is currently down over 7%, and if the correction continues, it could test the support at $8.59. Losing this level could lead to a drop as low as $7, falling below $8 for the first time since November 2024.

The post Top 5 Made In USA Cryptos To Watch In the Last Week of February appeared first on BeInCrypto.

Read more