Strive Doubles Down on Bitcoin With $500 Million Offering as Portfolio Slides Nearly 18%

Bitcoin treasury firm Strive has unveiled a $500 million at-the-market offering, with plans to allocate the funds toward broad corporate needs, including the purchase of Bitcoin (BTC).

The announcement comes as the firm faces an unrealized loss of nearly 18% on its existing Bitcoin holdings amid the cryptocurrency’s downturn.

Strive Targets Larger Bitcoin Holdings Despite Unrealized Losses

In a recent press release, Vivek Ramaswamy’s firm revealed that it has entered into a sales agreement. This enables the company to issue and sell up to $500 million of its Variable Rate Series A Perpetual Preferred Stock (SATA Stock) through an at-the-market offering.

The capital targets general corporate purposes, including acquiring Bitcoin and Bitcoin-related assets. Additional applications include working capital, income-generating asset purchases, potential share repurchases, and debt repayment.

“The SATA Stock, subject to the terms and conditions of the sales agreement, may be sold by the sales agents by any method that is deemed an “at-the-market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended or any other method permitted by law,” the press release read.

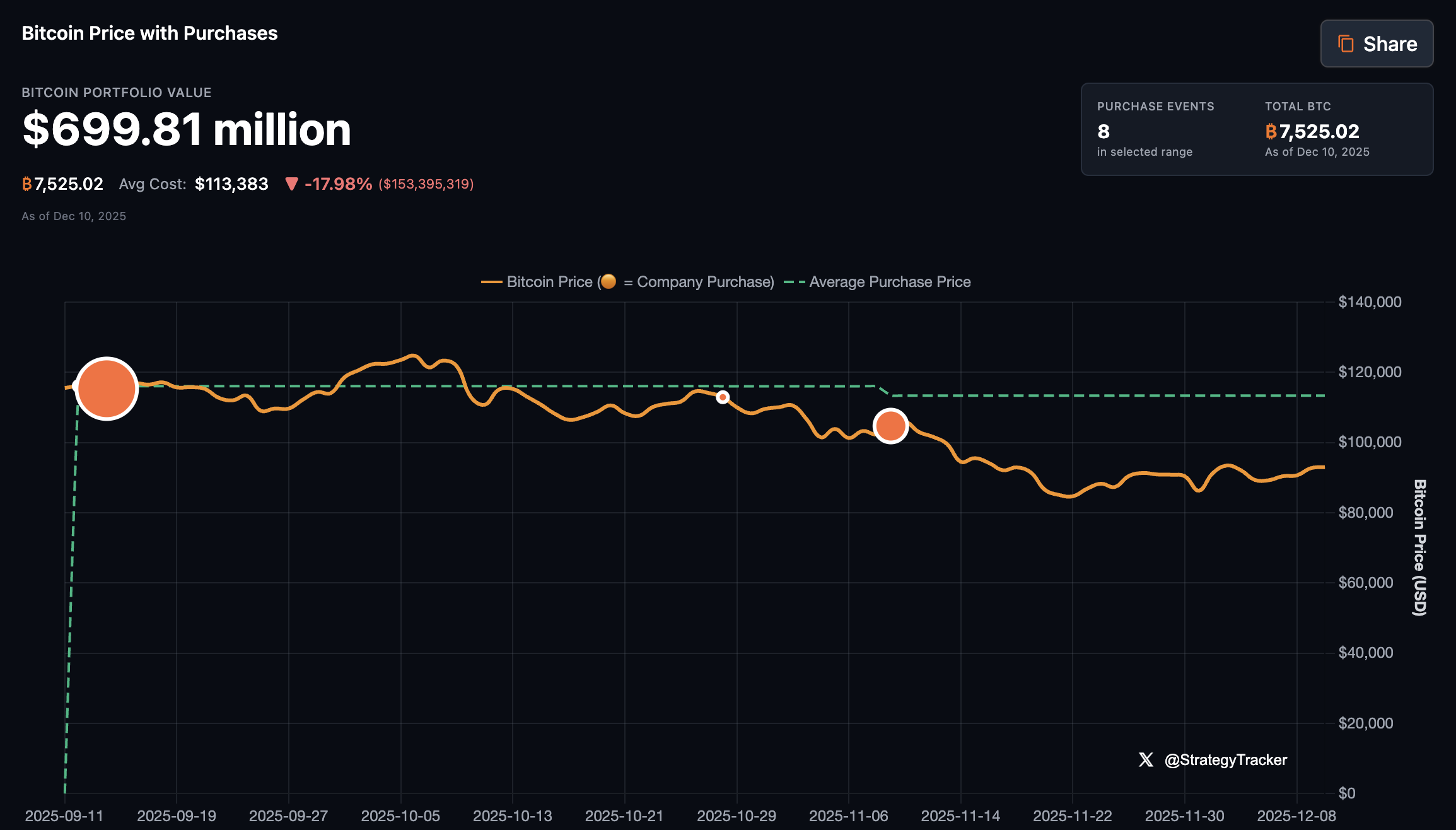

According to Strive’s Bitcoin Strategy Tracker, it has bought Bitcoin three separate times in 2025. In early September, the firm purchased 5,816 BTC, followed by a smaller purchase of 72 coins in late October. Lastly, Strive acquired 1,567 BTC in early November.

In total, the firm holds 7,525 BTC, making it the 14th largest public holder of Bitcoin. Its average acquisition cost is $113,383 per BTC.

As of the latest data, its Bitcoin holdings are valued at $699.81 million, reflecting an unrealized loss of roughly 18%, or about $153 million.

Digital Asset Treasury Firms Under Pressure

Meanwhile, it’s not just Strive. Data from Bitcoin Treasuries revealed that Metaplanet, GD Culture Group, Remixpoint, and more are sitting on unrealized losses due to Bitcoin’s market performance.

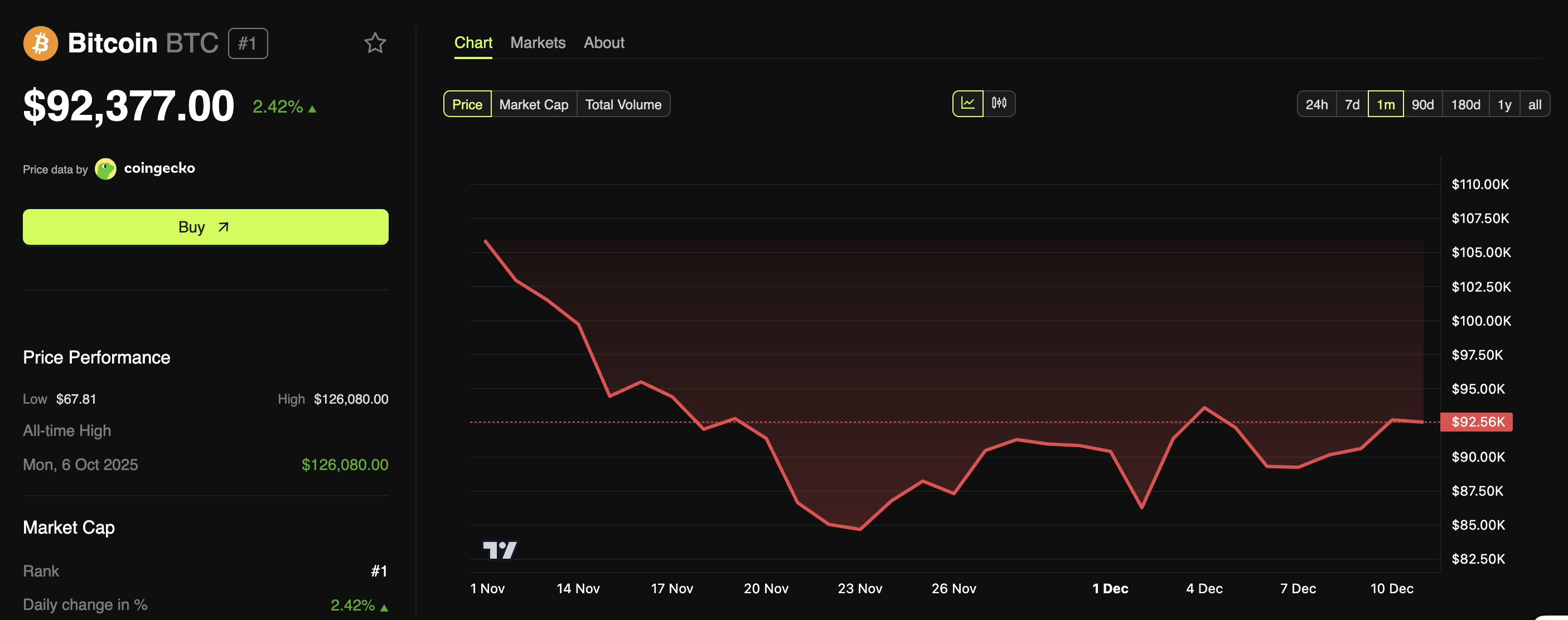

Bitcoin faced significant market headwinds in October, and the downtrend only accelerated in November. Midway through the month, BTC fell below the $100,000 level and has not yet managed to reclaim it.

However, over the past 24 hours, a modest recovery has been observed. At the time of writing, Bitcoin was trading at $92,377, representing a 2.42% increase.

Beyond market volatility, DAT firms now face structural pressures from index providers. MSCI has proposed that companies holding digital assets representing more than 50% of their total assets be recategorized as “funds.”

This could result in their removal from MSCI benchmarks. The decision carries critical consequences for DAT firms. Index exclusion would likely trigger major passive-index outflows.

Last week, Strive submitted a seven-page letter to MSCI’s chairman, urging him to reconsider the proposal.

“Index providers do not exclude energy companies whose oil reserves dominate their balance sheets, gold miners whose value depends largely on the metal they extract, or financial firms whose assets consist mostly of securities and derivatives…. Creating a special exclusion rule for digital assets alone would depart from that tradition without regulatory or economic rationale,” Strive wrote.

MSCI’s decision will be announced on January 15, 2026. The outcome will inform how traditional markets treat companies with substantial cryptocurrency treasuries and may affect the future of the Bitcoin treasury business model.

The post Strive Doubles Down on Bitcoin With $500 Million Offering as Portfolio Slides Nearly 18% appeared first on BeInCrypto.

Read more