Hyperliquid Delists JELLY JELLY Meme Coin To Avoid $230 Million in Losses

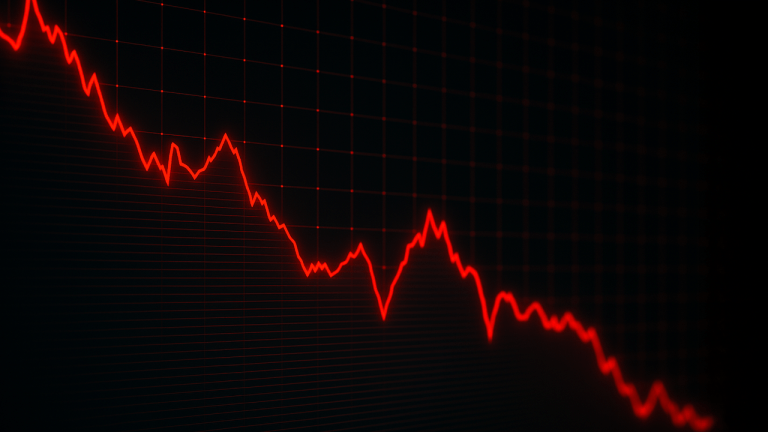

In a convoluted and dramatic scandal, HyperLiquid was rocked today by a massive JELLY short squeeze. It was forced to assume one trader’s liabilities, leaving it on the hook for $230 million.

As this situation developed, major CEXs like Binance and OKX listed JELLY perpetuals in what looks like a direct attack. HyperLiquid delisted the token, sparking extreme controversy.

What Happened with JELLY JELLY and Hyperliquid?

HyperLiquid, a popular DEX, is facing massive scrutiny after an interesting short squeeze. JELLY JELLY, a newly launched Solana meme coin, is at the center of the debacle.

Essentially, massive JELLY whales managed to manipulate the meme coin price, causing losses in HyperLiquid’s HLP vault.

“A massive whale with 124.6 million JELLYJELLY ($4.85 million) is manipulating its price to make Hyperliquidity Provider (HLP) face a loss of $12 million. He first dumped the token, crashing the price and leaving HLP with a passive short position of $15.3 million. Then he bought it back, driving the price up—causing HLP to suffer a loss of nearly $12 million,” LookonChain claimed via social media.

So, essentially, JELLY JELLY initially surged nearly 500% today. This dramatic jump was sparked by what’s called a “short squeeze.” It occurs when someone bets heavily that a coin’s price will fall (known as “shorting”), but instead, the price unexpectedly rises.

In this case, a trader borrowed a massive amount of JELLY tokens and sold them immediately. He expected the price to drop, buy the tokens back cheaper, and keep the difference as profit.

Unfortunately for the trader, the price didn’t fall—it skyrocketed, forcing them to buy back the coins at much higher prices, creating massive losses.

This sudden forced buying pushed the price even higher, catching the attention of traders and investors who jumped in to ride the wave. In under an hour, JELLY’s market cap rapidly increased from $10 million to $43 million.

This frenzy also left Hyperliquid, the exchange involved, holding a big loss of $6.5 million from the trader’s failed short position, sparking speculation about potential financial stress on the platform.

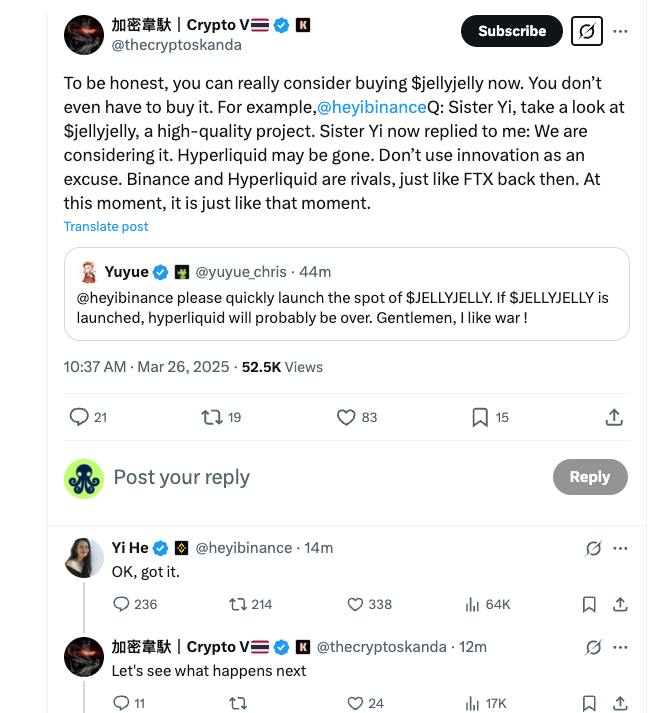

Meanwhile, Binance and OKX listed JELLY perpetuals, further driving its price up. So the potential loss became even larger for Hyperliquid. Some users even urged Binance and other competitors to list the token and deal a ‘death blow’ to Hyperliquid.

Binance is Apparently Trying to Liquidate HyperLiquid

In a very interesting twist, it looks like these competitors are heeding the call. Binance, the world’s largest crypto exchange, was hit with a wave of requests to list JELLY JELLY, thereby causing big losses for HyperLiquid.

Yi He, one of its co-founders, said she would consider a listing, and crypto sleuth ZachXBT claimed that the original whale was funded via Binance.

Shortly after these developments happened, Binance announced that it would begin offering perpetuals contracts for JELLY.

OKX also jumped on the bandwagon with perpetuals trading of its own. After this, HyperLiquid announced that it would delist JELLY JELLY, seemingly erasing its unrealized losses.

“After evidence of suspicious market activity, the validator set convened and voted to delist JELLY perps. All users apart from flagged addresses will be made whole from the Hyper Foundation. This will be done automatically in the coming days based on onchain data. There is no need to open a ticket. Methodology will be shared in detail in a later announcement,” HyperLiquid’s statement claimed.

This radical action immediately caused an explosion on social media. HyperLiquid’s supporters expressed unease over the JELLY JELLY incident, while its detractors accused the firm of criminal activity.

The firm’s validators confirmed that they unanimously took the decision, partially rebutting rumors that its CEO acted alone.

Still, there are no mincing words here. If HyperLiquid can simply declare its JELLY JELLY liabilities null and void, that’s a highly destabilizing act.

Commentators pointed out that this liquidation takeover mechanic is one of the main triggers that destroyed FTX.

The community will have to watch carefully to see how the situation develops, but this is very alarming.

The post Hyperliquid Delists JELLY JELLY Meme Coin To Avoid $230 Million in Losses appeared first on BeInCrypto.

Read more