Gemini Stock Slides Amid Leadership Upheaval and Operational Cutbacks

Centralized exchange Gemini recently announced that it parted ways with three senior executives. The leadership changes come amid broader operational cutbacks and workforce reductions.

Following the announcement, the company’s shares declined further, extending a downward trend that has persisted since Gemini went public last September. The latest developments have prompted renewed scrutiny over the exchange’s long-term outlook.

Executive Shakeup Follows Deep Cuts

In a recent blog post, Tyler and Cameron Winklevoss announced that Gemini had parted ways with its Chief Financial Officer, Chief Legal Officer, and Chief Operating Officer. They said interim replacements had been appointed for the CFO and CLO roles, while the COO position would not be filled.

The founders characterized the changes as part of a broader transformation at the company, referring to the initiative as “Gemini 2.0.” They noted that recent developments in the crypto industry have influenced this shift.

“During this time, but really more recently, rapid breakthroughs in AI have begun to dramatically transform the way we work at Gemini. Simultaneously, the advent of prediction markets has begun to dramatically transform marketplaces, including our own,” the blog post stated.

The announcement drew heightened attention as it followed Gemini’s decision weeks earlier to reduce its global workforce by 25%. In addition, Gemini has exited several international markets, including the United Kingdom, the European Union, and Australia.

The latest developments prompted renewed volatility in the company’s stock, extending a steep decline that has persisted since its September listing. Investors who purchased GEMI at its $28 IPO price are now facing losses of roughly 77%.

In a recent SEC filing, the company also disclosed an estimated net loss of approximately $595 million for 2025.

Taken together, these developments have intensified scrutiny of the exchange’s valuation.

Public Markets Reprice Gemini Growth

The sharp repricing of Gemini’s stock has renewed debate over whether the exchange was fundamentally overvalued at its initial public offering (IPO).

Its initial valuation reflected expectations of sustained trading volumes and revenue expansion. Given the cyclical nature of the crypto market, pricing may have been influenced by elevated trading activity and heightened retail participation.

The subsequent decline, unfolding amid a broader market downturn, suggests a reassessment of earnings expectations.

The developments also highlight intensifying competitive pressures between centralized exchanges.

Market share and liquidity remain concentrated among larger platforms with deeper order books and stronger network effects. Meanwhile, mid-tier exchanges face rising fixed costs without equivalent trading scale to support margins.

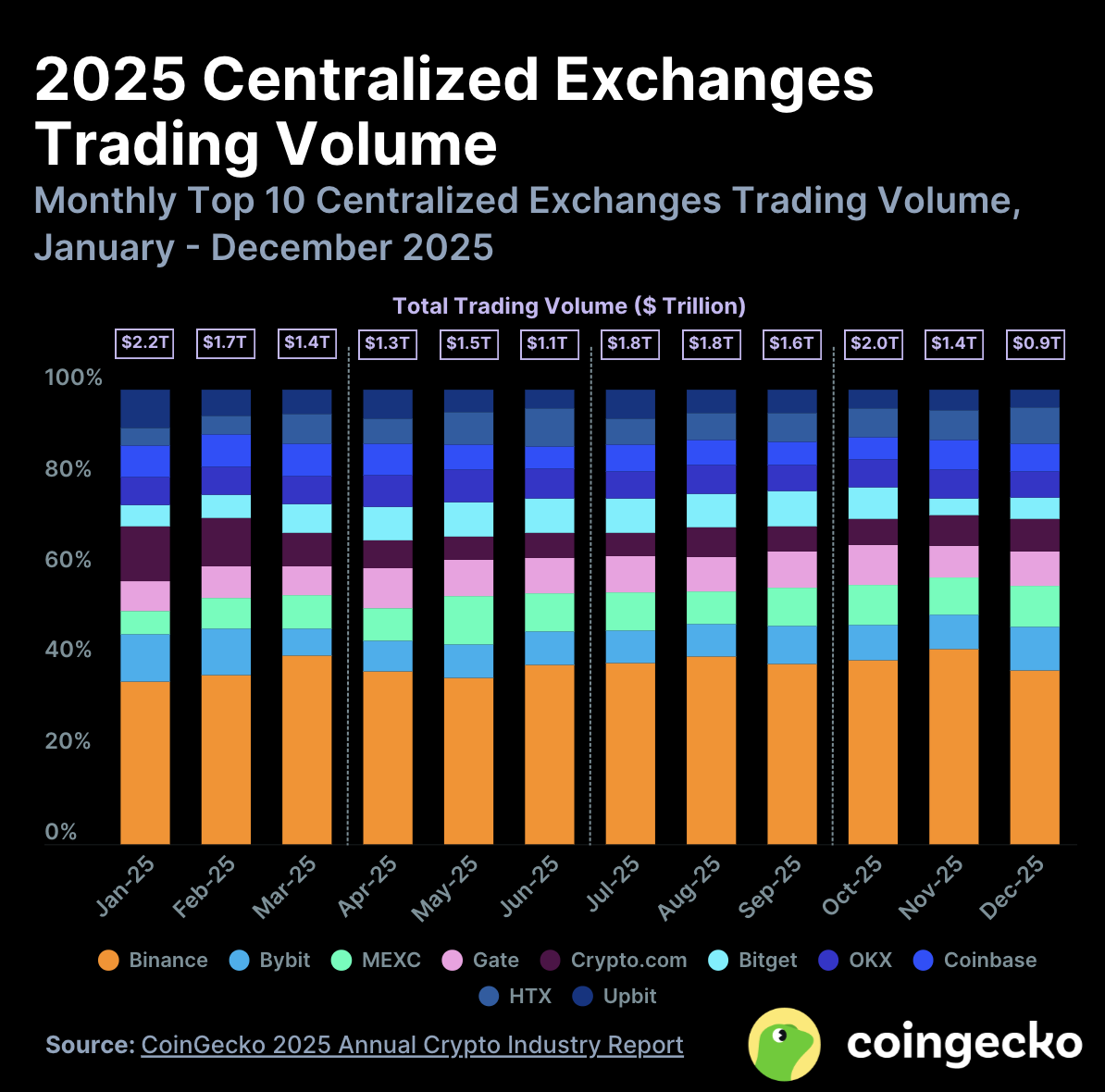

Recent data from CoinGecko supports the situation.

In a January report on centralized exchange market share by trading volume, the data aggregator found that in 2025, Binance accounted for 39.2% of total spot volume among the top exchanges, processing $7.3 trillion in volume. Other leading platforms, including Bybit, MEXC, and Coinbase, also maintained meaningful shares of global volume.

Gemini did not place among the top 10. According to CoinMarketCap data, the exchange currently ranks 24th, with a 24-hour trading volume of $54 million.

Within that context, workforce reductions and geographic pullbacks may represent cost-control measures and strategic adjustments to an increasingly consolidated market.

How Gemini executes this transition will likely shape whether shareholders view the current turbulence as a short-term adjustment or a sign of longer-term structural challenges.

The post Gemini Stock Slides Amid Leadership Upheaval and Operational Cutbacks appeared first on BeInCrypto.

Read more