Ethereum Slips to December 2023 Lows as Bears Threaten a Sub-$2,000 Plunge

Ethereum’s price has dropped another 13% over the past week. During Monday’s early Asian hours, the leading altcoin plunged to $1,997—its lowest level since December 2023.

With a growing bearish bias, the cryptocurrency may soon slip below the critical $2,000 support level once again.

ETH Selloffs Surge as 50% of Holders Slip Into Losses

An assessment of the ETH/USD one-chart reveals that the altcoin trades significantly below its Ichimoku Cloud and has done so since January 25.

At press time, the Leading Spans A (green) and B (red) form dynamic resistance above the altcoin’s price at $2,346 and $2,742, respectively.

The Ichimoku Cloud tracks the momentum of an asset’s market trends and identifies potential support/resistance levels. When the price trades above this cloud, the market is in an uptrend.

Conversely, when an asset’s price falls below the cloud, the market is in a downtrend. In this scenario, the cloud acts as a dynamic resistance zone above ETH’s price. It reinforces the likelihood of continued downward movement if the coin’s price remains under it.

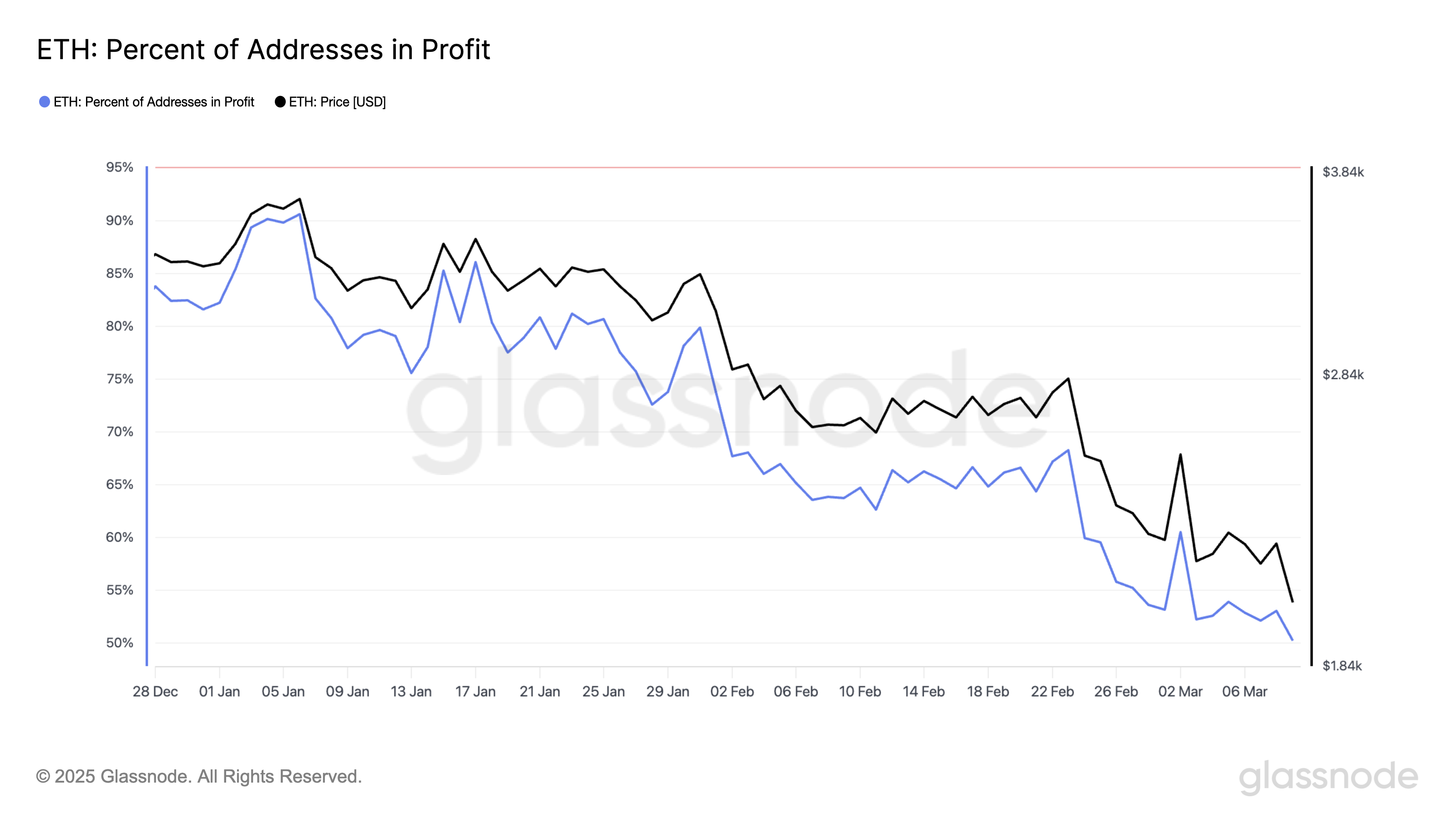

Further, ETH’s falling prices have plunged many holders into losses. Per Glassnode, the percentage of ETH wallet addresses whose funds have an average buy price lower than the coin’s current price has dropped to a year-to-date low of 50%.

This means that only 50% of all addresses holding ETH are in profit. For context, it was 82% at the beginning of the year. The trend can worsen the selloffs among ETH traders, as many are now attempting to offload their holdings to minimize losses.

If selling intensifies, it can further drive ETH’s prices down, reinforcing bearish momentum and potentially triggering more stop-loss sell-offs.

Ethereum’s Next Move: $1,924 Breakdown or a Rally Past $2,500?

ETH’s $2,000 support may not hold if selling pressure persists. This could potentially open the door to further losses in the coming days. Readings from its Fibonacci Retracement tool suggest that the coin’s price could fall to $1,924 if demand weakens further.

However, a positive shift in market sentiment would invalidate this bearish projection. If ETH witnesses a resurgence in new demand, it could drive its price to $2,224. Should the coin flip this resistance into a support floor, it could propel ETH’s price toward the highly coveted $2,500 region

The post Ethereum Slips to December 2023 Lows as Bears Threaten a Sub-$2,000 Plunge appeared first on BeInCrypto.

Read more