Ethereum Outshines Bitcoin Even As Price Remains Stuck Under $3,000

Ethereum continues to struggle with price recovery as it repeatedly fails to close above the $3,000 level. ETH has shown brief upside attempts, only to retreat under selling pressure.

While price action remains frustrating for holders, underlying network data points to strengthening fundamentals that may support future recovery.

Ethereum Holders Are Staying

Ethereum leads all major cryptocurrencies in non-empty wallet count. The network hosts more than 167.9 million active addresses holding balances. Bitcoin, by comparison, has about 57.62 million. Other top-cap assets trail significantly behind both networks.

This dominance highlights Ethereum’s broad user base and diverse use cases. Decentralized finance, NFTs, and smart contract activity continue to drive engagement. Strong participation reflects confidence, which plays a critical role in sustaining demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

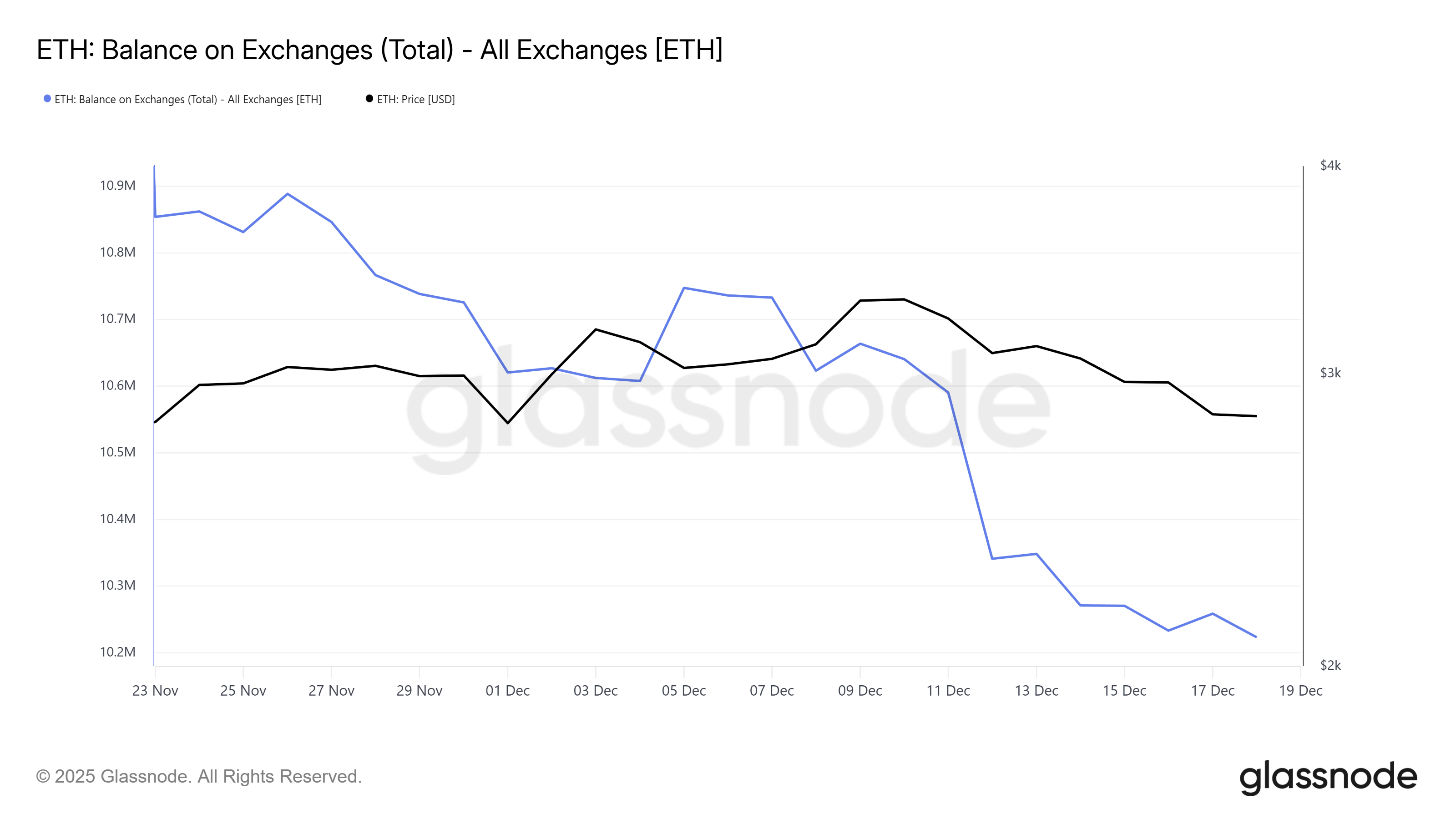

Macro indicators further support a constructive outlook. Ethereum balances on centralized exchanges have declined steadily. Since the start of the month, roughly 397,495 ETH have been withdrawn from exchanges, reducing immediate sell-side supply.

These outflows suggest accumulation at current price levels. The withdrawn ETH is valued at over $1.17 billion, signaling confidence among long-term investors. Lower exchange balances often precede reduced selling pressure, which can support price recovery when demand strengthens.

ETH Price Could Breach The Critical Barrier

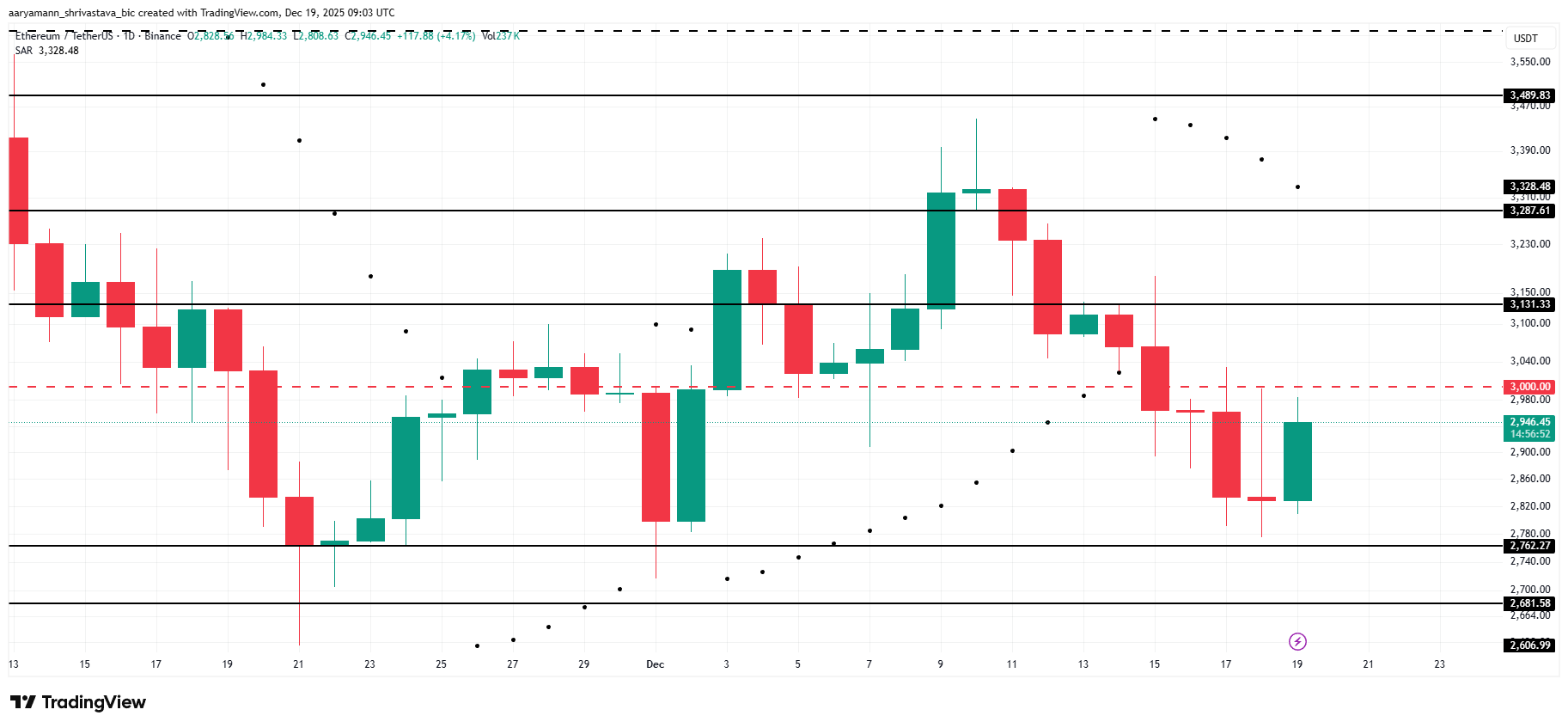

Ethereum trades near $2,946 at the time of writing, remaining below the psychological $3,000 level. The asset has consistently bounced off the $2,762 support zone over recent weeks. This behavior indicates buyers are defending lower levels despite broader uncertainty.

If supportive trends continue, ETH could attempt another breakout above $3,000. A successful move may open the path toward $3,131. Continued momentum could extend gains toward $3,287, signaling improving confidence among both retail and institutional participants.

Risks persist if selling pressure intensifies. A breakdown below $2,762 would weaken the recovery narrative. Losing this support could send Ethereum toward the $2,681 level, marking a four-week low and invalidating the bullish thesis outlined by improving on-chain metrics.

The post Ethereum Outshines Bitcoin Even As Price Remains Stuck Under $3,000 appeared first on BeInCrypto.

Read more