Crypto Outflows Hit $795 Million as Trump’s Tariffs Weigh Heavy on Investor Sentiment

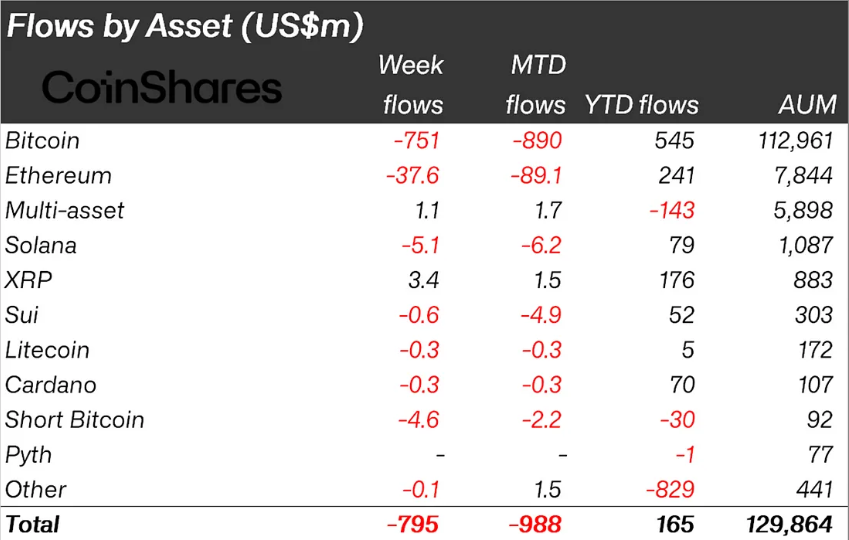

According to the latest CoinShares research, crypto outflows hit $795 million last week. This marks the third consecutive week of negative flows, as financial uncertainty continues to weigh heavy on investor sentiment.

This report aligns with the outlook for Bitcoin spot ETFs (exchange-traded funds), which saw $713 million in outflows last week, a 314% surge from the prior week’s $172.69 million.

Crypto Outflows Reached $795 Million Last Week

CoinShares’ researcher James Butterfill reveals that while Bitcoin led the outflows at $751 million, some altcoins, including XRP, Ondo Finance (ONDO), Algorand (ALGO, and Avalanche (AVAX), managed positive flows.

It suggests investors adjust their investment strategies, pivoting to altcoins as broader economic chaos bombards the Bitcoin (BTC) market.

“…recent tariff activity continues to weigh on sentiment towards the asset class,” wrote Butterfill.

This trend is not new, as altcoins have outperformed Bitcoin on flow metrics in the past. Two weeks ago, altcoins broke a five-week streak of negative flows, catapulting crypto inflows to $226 million.

Meanwhile, the influence of Trump’s tariffs on digital asset investment products has been consistent. In the week ending April 7, crypto outflows hit $240 million in the backdrop of Trump’s trade chaos.

Investor sentiment took a particularly sharp turn after President Donald Trump’s tariff pause announcement sidelined China, reigniting fears of a US-China trade war. This spooked markets across traditional and digital assets, along with China’s retaliatory move, exacerbates the sentiment.

Nevertheless, despite sidelining China, Trump’s temporary rollback of tariffs helped lift assets under management (AuM) by 8% to $130 billion, up from the lowest point seen since November 2024.

“… a late-week price rebound helped lift total AuM from their lowest point on April 8 (the lowest since early November 2024) to $130 billion, marking an 8% increase following President Trump’s temporary reversal of the economic calamitous tariffs,” Butterfill added.

Bitcoin Bleeds, ETF Flows Confirm Sentiment

As indicated, Bitcoin bore the brunt of last week’s bearish turn. Outflows surged in line with a 314% week-over-week increase in Bitcoin ETF outflows. The consistent bleed highlights that institutional interest is cooling, particularly among US-based ETF providers.

Short-Bitcoin products also suffered, with $4.6 million in outflows. This suggests traders may retreat to the sidelines entirely rather than taking leveraged bets on downside movement.

CoinShares emphasized that last week’s outflows spanned multiple regions and product providers. This signals that the bearish tone is not isolated to any one market. It aligns with broader risk-off behavior across equities and commodities in response to the volatile US trade stance.

Trump’s unpredictable tariff moves have reintroduced uncertainty into a fragile macro environment. Crypto markets, particularly institutional products, are responding with a broad withdrawal of capital.

The post Crypto Outflows Hit $795 Million as Trump’s Tariffs Weigh Heavy on Investor Sentiment appeared first on BeInCrypto.

Read more