Crypto Markets Crash As US-China Trade War Officially Begins With Trump’s 100% Tariff

The global crypto market plunged again late Friday after US President Donald Trump announced sweeping new tariffs and export controls on China, escalating tensions to their highest point since 2019.

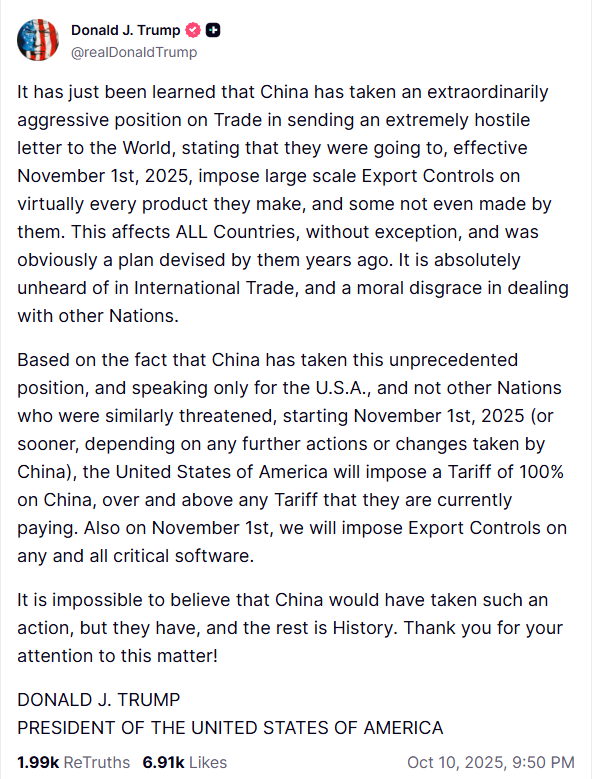

In a statement posted online, Trump said the US would impose a 100% tariff on all Chinese imports starting November 1, citing what he called Beijing’s “extraordinarily aggressive” move to impose broad export controls on “virtually every product they make.”

US and China Enter Their Biggest Trade War Since 2019

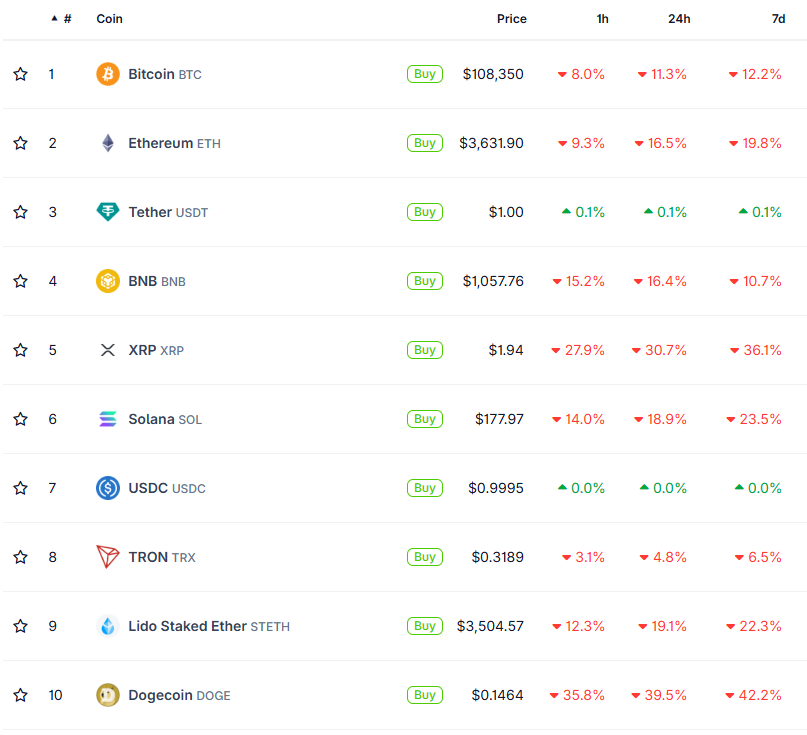

The announcement triggered immediate market turmoil. Within hours, the total cryptocurrency market capitalization fell from around $4.25 trillion to $4.05 trillion, wiping out nearly $200 billion in value, according to CoinGecko.

Bitcoin crashed 10% to $107,000 from $122,000. Ethereum, XRP, and BNB dipped more than 15%.

This second wave of losses comes just hours after Trump’s earlier post canceled a planned meeting with Chinese President Xi Jinping and threatened a “massive” tariff increase.

That initial statement caused the first major sell-off, erasing about $125 billion in crypto value and over $800 million in leveraged positions.

The latest declaration, however, signals a shift from rhetoric to policy, doubling tariffs to unprecedented levels and expanding the dispute to include software and technology controls.

This move effectively confirms a full-scale trade confrontation, sparking a broad “risk-off” retreat across equities, commodities, and digital assets.

Market watchers warn that the combined impact of tariffs and export restrictions could strain the global technology supply chain — particularly in semiconductors, AI, and blockchain infrastructure — deepening uncertainty in sectors that underpin digital assets.

The timing of the escalation caught markets off-guard, intensifying liquidation pressure on leveraged positions.

Bitcoin’s decline is now testing key psychological levels, while altcoins continue to underperform amid heavy selling.

For now, traders are bracing for a volatile weekend. The market’s next direction will hinge on whether Beijing responds in kind or signals willingness to reopen negotiations before November 1.

The post Crypto Markets Crash As US-China Trade War Officially Begins With Trump’s 100% Tariff appeared first on BeInCrypto.

Read more