Crypto Liquidations Hit $1.5 Billion as Market Sentiment Dips to 2025 Lows

Crypto liquidations rise over $1.5 billion in 24 hours, pushing fears of a bear market. This is the third time in February that market liquidations have exceeded the billion mark in a 24-hour period.

However, even if the worst predictions come true, analysts think crypto is still well-positioned to consolidate and come back stronger by mid-2025.

Flash Crashes and Liquidations on the Rise

Rumors of a bear market are circulating throughout the crypto market. Bitcoin ETFs are seeing huge outflows with little sign of stopping, and this is having a negative effect on the asset’s price.

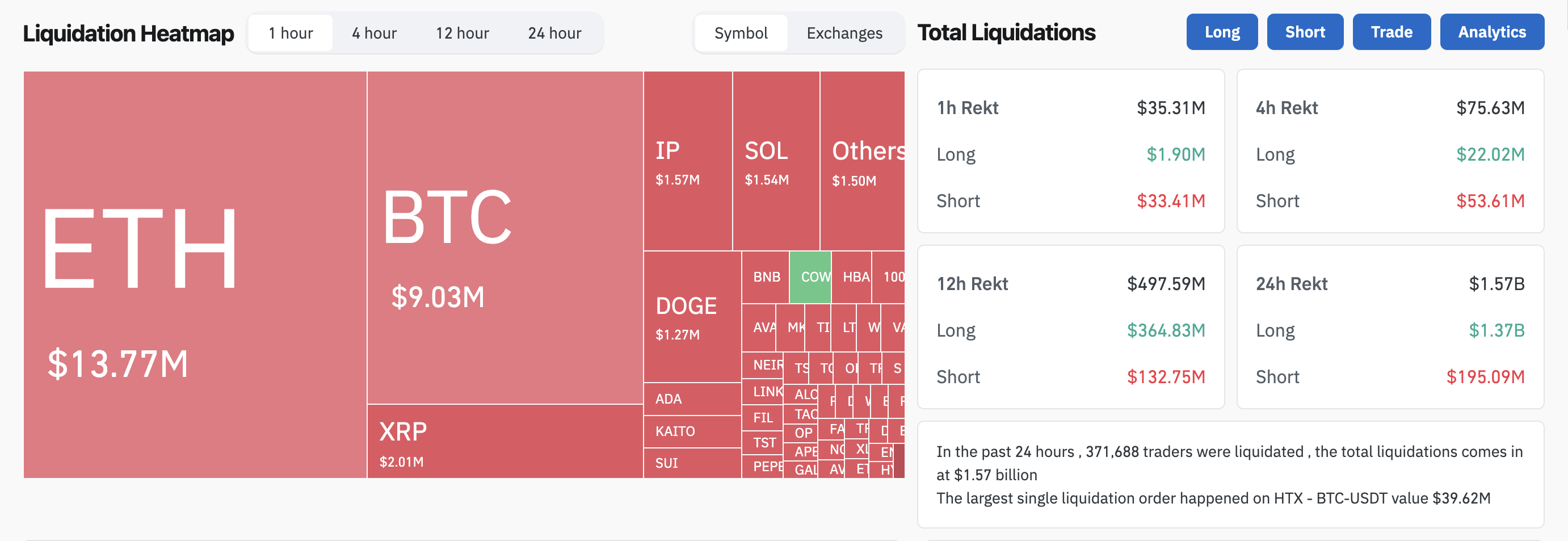

However, a broader look at the data shows heightened losses all across crypto, with over $1.5 billion in total liquidations in the last 24 hours:

Bitcoin is the biggest cryptoasset, and its declines are linked to a titanic ETF market, but it is not the biggest loser today. Ethereum was a standout for crypto liquidations, partially in the fallout from last week’s Bybit hack.

Bitcoin fell below $90,000 today, for the first time in over three months. The large amount of consecutive ETF outflows also reflects retreat from institutional investors.

Meanwhile, Ethereum saw the largest liquidations, as the fallout from last week’s Bybit hack is still visible to some extent. Most notably, today’s crash reflects a trend of frequent flash crashes in the market.

In 2025, the crypto market has witnessed four major crashes in a 24-hour window, driven by different macroeconomic factors.

Although the market has quickly recovered each time, the freuqency of these liquidations are concerning. However, it signals a clear trend that market sentiment is changing rapidly in the market, even more frequently than in previous cycles.

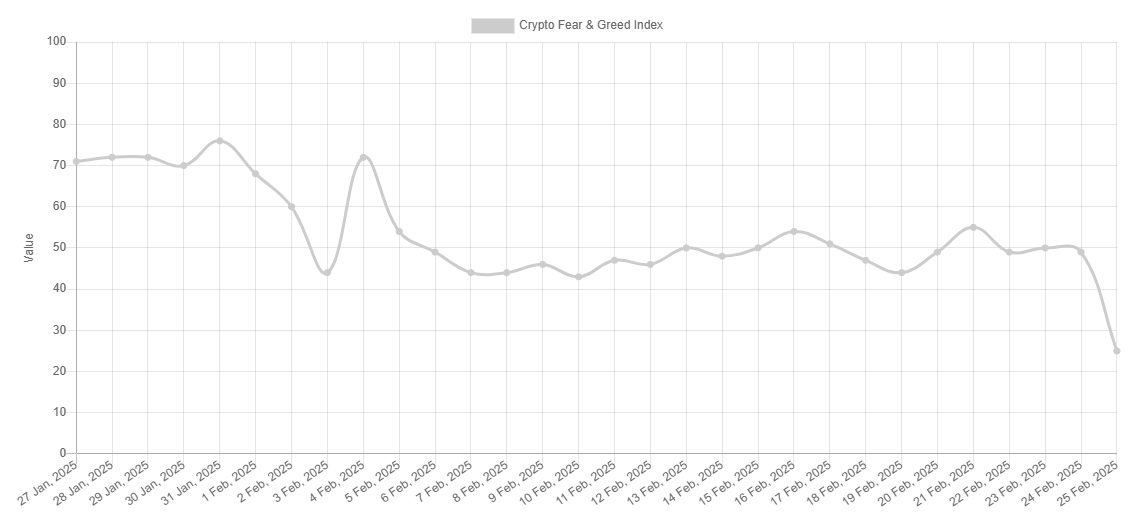

If we look at the fear and greed index from the past three months, this volatility in market sentiment is evident. Also, the market sentiment is currently at its lowest in 2025.

Despite these major crypto liquidations, not everybody in the industry is feeling bearish. Binance CEO Richard Teng claimed that these developments are a tactical retreat, not a reversal.

“Price movements often overshadow what’s happening beneath the surface, but the fundamental drivers of crypto growth remain firmly intact. Market corrections can feel unsettling, but they are also moments when experienced investors position themselves for the next bull trend. For those focused on the bigger picture, volatility presents an opportunity,” the Binance CEO claimed.

In other words, Teng encouraged pessimists to remember the cyclical nature of this industry. Massive crashes have happened before, and indeed, they will happen again.

All the leading crypto projects are facing liquidations; Solana’s price is at a four-month low and XRP is at its lowest point since December. Nonetheless, the industry has strong foundations.

The crypto industry’s political movement is still in its ascendancy, and institutional investors have a huge level of interest. Teng could only speak for his own firm, but Binance data shows a steady growth of new users.

Whenever the dust settles after these liquidations, the crypto community might find itself consolidated to pursue even larger gains.

The post Crypto Liquidations Hit $1.5 Billion as Market Sentiment Dips to 2025 Lows appeared first on BeInCrypto.

Read more