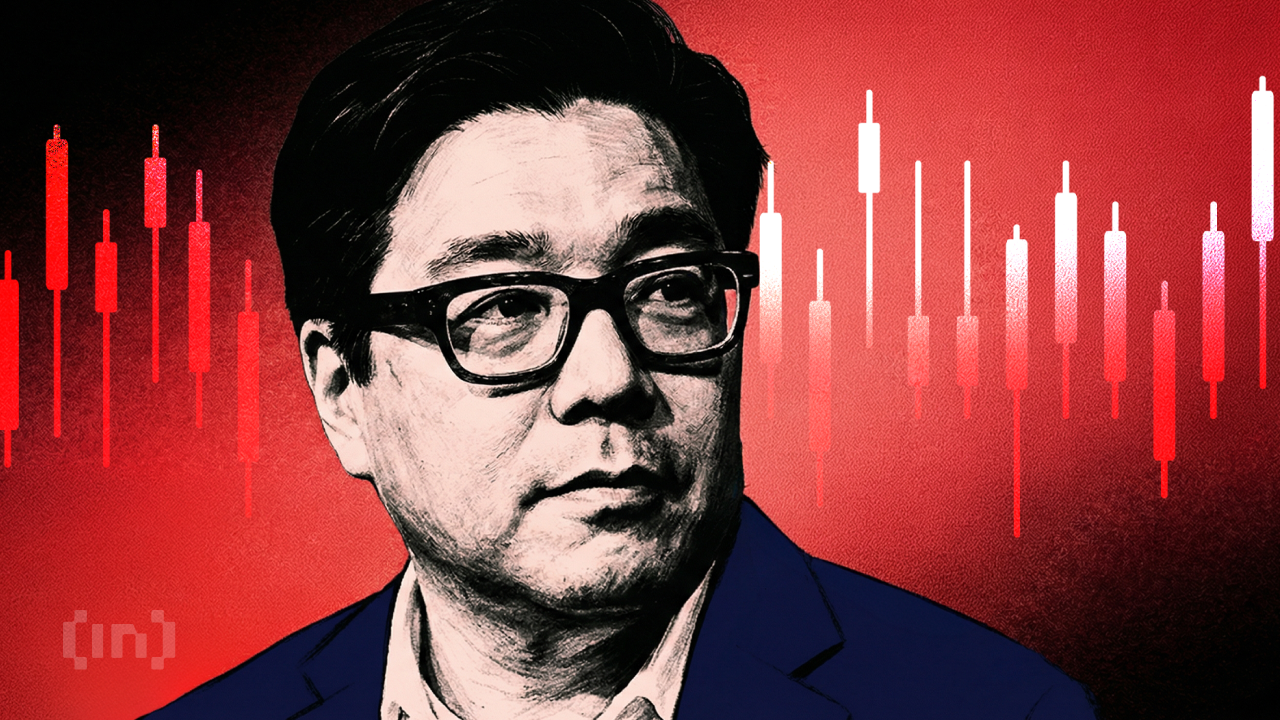

BitMine Faces Over $6 Billion in Unrealized Losses, but Tom Lee Says It’s Part of the Plan

BitMine Immersion Technologies Chairman Tom Lee said unrealized losses on the company’s Ethereum (ETH) holdings during market downturns are “a feature, not a bug,” emphasizing the nature of its Ethereum-focused treasury model.

His comments come as the world’s largest ETH treasury’s paper losses climb to more than $6 billion amid a broader market downturn that has pushed the second-largest cryptocurrency to multi-month lows.

BitMine’s Unrealized Losses Exceed $6 Billion

BeInCrypto Markets data shows that Ethereum has fallen more than 24% over the past week. This marks the steepest weekly decline among the top 10 cryptocurrencies by market capitalization.

On Tuesday, ETH briefly dropped to $2,109 on Binance, its lowest level since May 2025. At the time of writing, the altcoin was trading at $2,270, down 3.06% over the past day.

The sharp sell-off has intensified pressure on digital asset treasuries, with major holders facing significant unrealized losses amid broader market weakness.

According to data from CryptoQuant, BitMine is currently sitting on approximately $6.4 billion in paper losses from its Ethereum holdings.

Some critics even worry that these sizable holdings could limit future ETH price growth if BitMine chooses to liquidate. However, in a post on X (formerly Twitter), Lee pushed back against criticism of Ethereum-focused treasury companies, arguing that recent losses reflect market conditions rather than structural flaws.

He stated BitMine is structured to track the price of Ethereum and potentially outperform it over a full market cycle. As the broader crypto market remains in a downturn, declines in ETH are naturally translating into paper losses.

“BMNR will see ‘unrealized’ losses on our holdings of ETH during these times: it’s a feature, it’s not a bug. shall we call out all index ETFs for their losses? Bottom line: ethereum is the future of finance,” Lee stated.

The latest statement comes after the BitMine chairman suggested that recent turbulence in Bitcoin and Ethereum may be temporary. This reflects the executive’s conviction in Ethereum, further supported by BitMine’s continued ETH purchases.

According to CoinGecko, the firm has acquired more than 141,000 ETH over the past month, bringing its total holdings to 4,285,125 ETH. The firm is not alone in its ETH purchases.

On-chain data shows active Ethereum accumulation by investors. Lookonchain identified three previously dormant, likely linked wallets that spent $13.1 million to acquire 5,970 ETH at an average price of $2,195 during the recent dip. In a separate transaction, an OTC whale purchased 33,000 ETH worth $76.6 million.

Trend Research Faces $562 Million Loss Amid Deleveraging

While accumulation continues, selling pressure is also building on the other side of the market. Trend Research, led by Jack Yi, has consistently been moving ETH onto exchanges.

According to OnChain Lens, the firm deposited 15,000 ETH, worth $33.08 million, into Binance today. In total, Trend Research has transferred 153,588 ETH to the exchange.

The selling activity comes amid significant unrealized losses on the firm’s existing positions, increasing pressure amid ongoing market volatility. A sustained decline in Ethereum’s price could trigger liquidations, with Trend Research’s estimated liquidation range around $1,800 per ETH.

The contrast between BitMine’s steady accumulation and Trend Research’s selling highlights the divergent strategies shaping the Ethereum market in February 2026.

The post BitMine Faces Over $6 Billion in Unrealized Losses, but Tom Lee Says It’s Part of the Plan appeared first on BeInCrypto.

Read more