Bitcoin Sell-Off Could Be a Textbook ‘Breakout and Retest’ Play: Godbole

Remember the last time you went on vacation? After locking the door and heading toward your car, you likely turned back abruptly to ensure the lock was secure before continuing your journey.

Financial markets, led by a range of human emotions, exhibit similar behaviors. After a convincing move beyond a long-held resistance, assets typically return to confirm the validity of the breakout. That serves as a test of the strength of the former resistance-turned-support, following which bigger rallies unfold.

The “breakout and retest play” phenomenon is well-known across asset classes. Bitcoin’s (BTC) ongoing sell-off might be just that – a healthy retest of the breakout point or the former resistance-turned-support of $73,835 breached in November.

In other words, the downward momentum could run out of steam at or closer to these levels, potentially setting the stage for a bigger run higher.

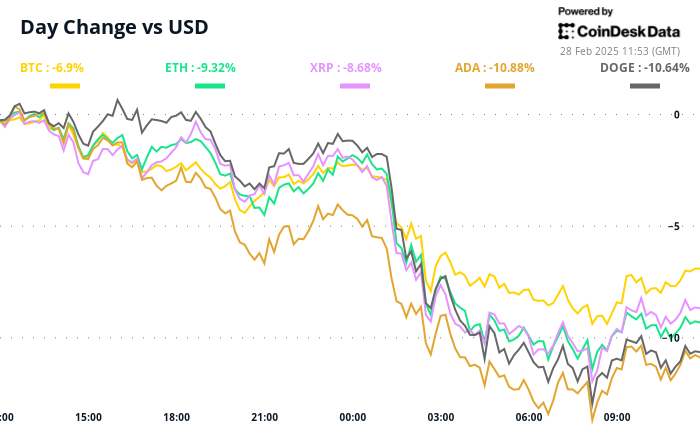

BTC has dropped over 15% to under $80,000 this month, exposing the former resistance-turned-support at $73,835. Prices broke above that level in early November, ending months-long consolidation after pro-crypto Donald Trump won the U.S. Presidential election.

The tendency of markets to retrace or revisit the breakout point before staging more enormous rallies has its roots in the behavioral aspects of investing.

People are generally risk averse when it comes to securing gains. So, when facing profits, traders quickly book those instead of allowing the winning trade to run wild. The so-called prospect theory explains why post-breakout rallies abruptly run out of steam, often leading to a retest of the breakout point. BTC holders have been taking profits around the $100K mark since December.

Now, as prices turn lower and near the breakout point, in this case, $73,835, market participants who missed the initial rally jump in, ensuring the level holds. The resulting bounce from the former resistance-turned-support draws in more and more buyers, potentially yielding a bigger rally.

That’s precisely what happened in the third quarter of 2023 and August-September 2020.

On both occasions, the breakout and retest produced bigger rallies to new record highs. Traders, however, need to note that a failed retest or a lack of a meaningful bounce indicates underlying weakness that can evolve into a full blown downtrend.

Over the years, I have seen numerous examples of retests of breakouts/breakdowns leading to bigger moves in traditional markets.

Consider the yield on the 10-year Japanese government bond. It triggered a double-bottom breakout in January 2024 and revisited the breakout level multiple times before rising to multi-year highs.

The AUD/USD pair dived out of a major support trendline in December, hinting at a deeper slide. The pair bounced to the trendline resistance early this month only to see sharp losses this week.