Bitcoin ETF Outflows Spark Fears of a Bear Market

Concerns about a bear market are growing as Bitcoin ETF outflows ramp up dramatically alongside the ongoing volatility. Other hopes, like state-level Bitcoin Reserves, are failing, and it’s difficult to find a clear bullish trend.

Industry experts like Arthur Hayes predict that any losses will be temporary, with a fierce rebound by the end of the year. However, this would be the first major price collapse since ETF approval and institutional adoption, and non-crypto-native investors could behave in unpredictable ways.

Is Bitcoin Headed for a Bear Market?

Bitcoin, the world’s first and largest cryptocurrency, has been on a downward price trajectory lately. Strategy (formerly MicroStrategy) saw a huge drop in stock price despite spending nearly $2 billion on the asset, and broader economic headwinds are having a real dampening effect.

A few worrying trends are building speculation about a Bitcoin bear market:

“Bitcoin goblin town incoming: Lots of IBIT holders are hedge funds that went long ETF [and] short CME futures to earn a yield greater than where they fund, short term US treasuries. If that basis drops as BTC falls, then these funds will sell IBIT and buy back CME futures,” claimed Arthur Hayes, former CEO of BitMEX.

Hayes also referenced his earlier prediction from January that the asset was set for a price drop to $70,000. This bear market will not last forever, he claimed, and Bitcoin would rebound by the end of the year, but it would face significant pain first.

Hayes’ predictions centered around the US Bitcoin ETF market, which has been facing its own pressures.

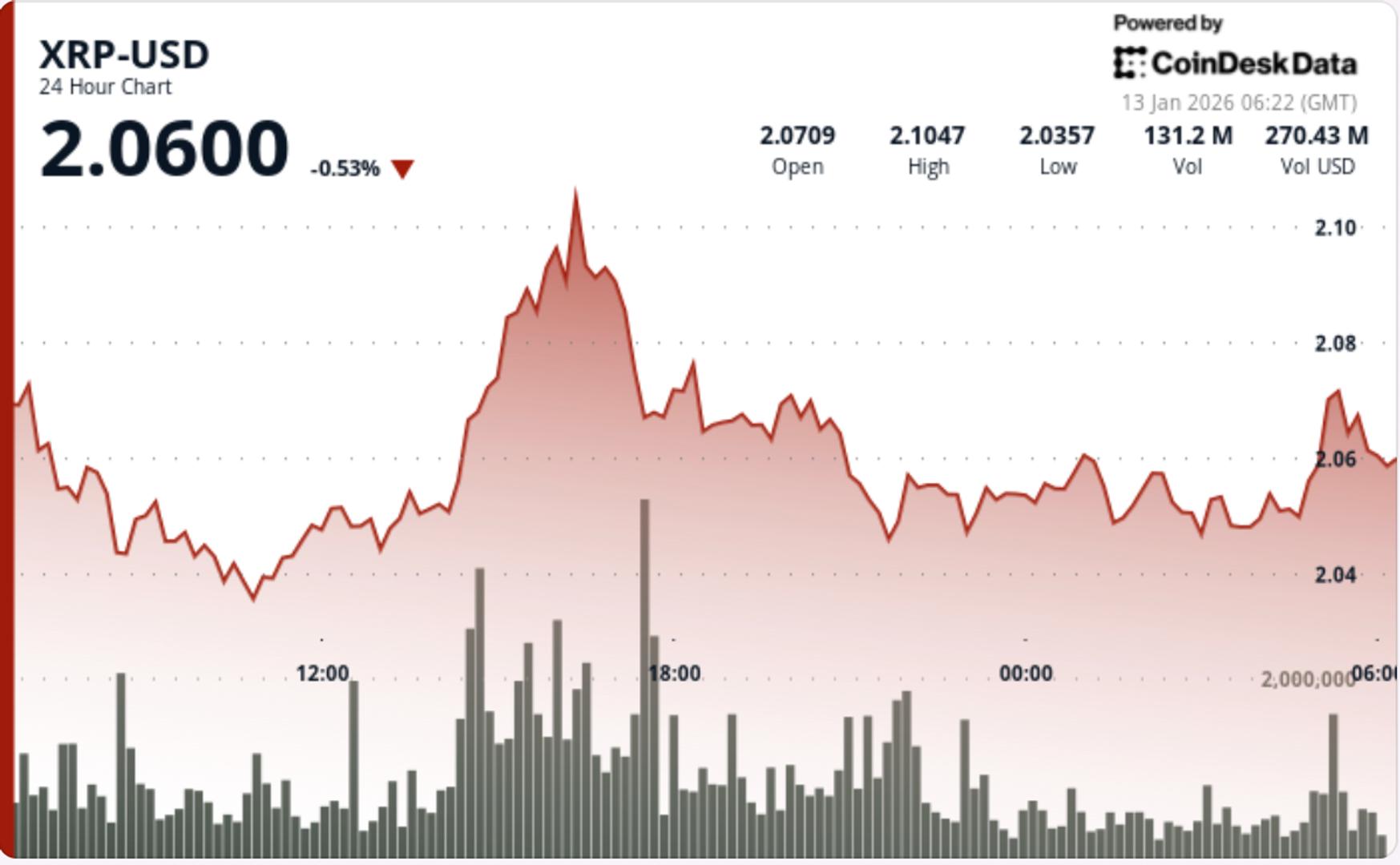

These ETFs are indeed showing signs of a bear market, caused by one simple correlation: the tendency of Bitcoin to decline alongside traditional stocks.

Even though there is a huge appetite for institutional investment, it’s very shallow in some ways. If BTC’s potential returns diminish, investors will look elsewhere, as evidenced by substantial outflows.

These one-day outflows total over $500 million from the top 10 ETFs alone. Last week, however, the entire market had $585 million in outflows, the worst level in five months.

If ETF outflows keep accelerating at this dramatic pace, a Bitcoin bear market seems very likely.

Bitcoin Reserve Hopes Fail, Deflating Enthusiasm

Another factor might cause additional downward pressure if political developments don’t live up to hopes. Specifically, many US states launched efforts to enact Bitcoin Reserves, which would trigger up to $23 billion in BTC purchases.

However, some Republican members themselves are defeating these efforts nationwide. With its other setbacks, can Bitcoin bear a major disappointment here?

In short, many factors are making a Bitcoin bear market seem like a credible prospect. However, the industry is no stranger to harsh price fluctuations. Hayes and other commentators have claimed that it will be temporary at best, with a rebound by the end of 2025.

The only question, then, is how a non-crypto-native investor class will deal with these cyclical patterns. Since the Bitcoin ETFs were approved in 2024, the industry has yet to face a genuine bear market on par with previous collapses.

Institutional investors have recently poured billions into crypto, but it’s uncertain how they will deal with the volatility inherent in this industry.

The post Bitcoin ETF Outflows Spark Fears of a Bear Market appeared first on BeInCrypto.

Read more