BERA’s Price Recovery Sparks Hope, But Negative Sentiment Looms

BERA has experienced a remarkable 30% price surge in the past 24 hours, recovering a significant portion of early February losses. Investors welcomed the rally, hoping for sustained gains.

However, market indicators suggest potential headwinds that could challenge the altcoin’s uptrend.

Berachain Bears Make Their Moves

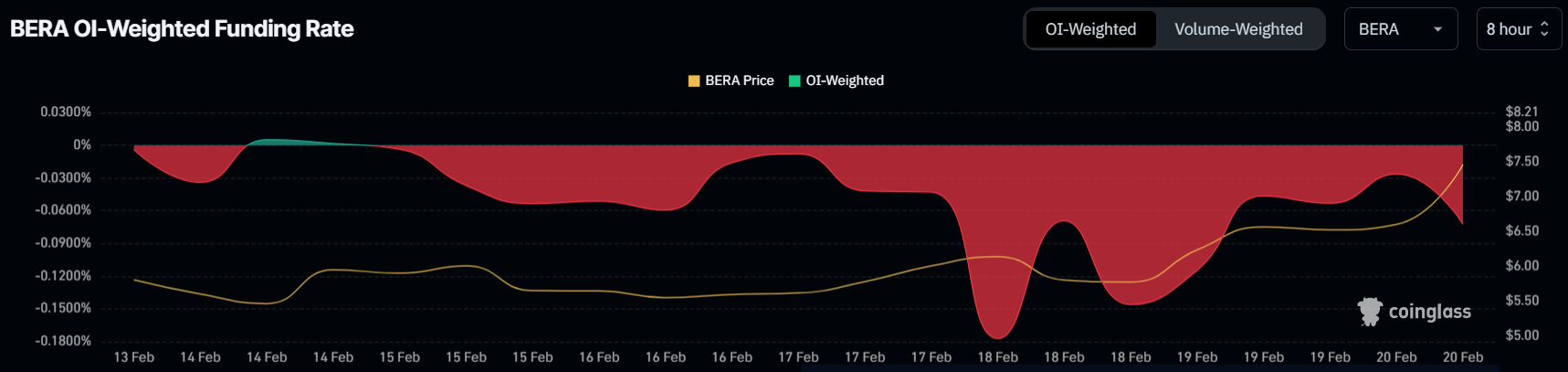

Despite the recent rally, BERA’s funding rate remains deeply negative. This indicates that a majority of traders are placing short contracts against the cryptocurrency. Such positioning suggests that market participants anticipate a pullback in the coming days, aiming to capitalize on a potential decline.

The negative sentiment underscores a cautious outlook among investors. Many are hedging against the possibility of a reversal, signaling a lack of confidence in the sustainability of BERA’s price increase. As short interest builds, downward pressure on the altcoin could intensify.

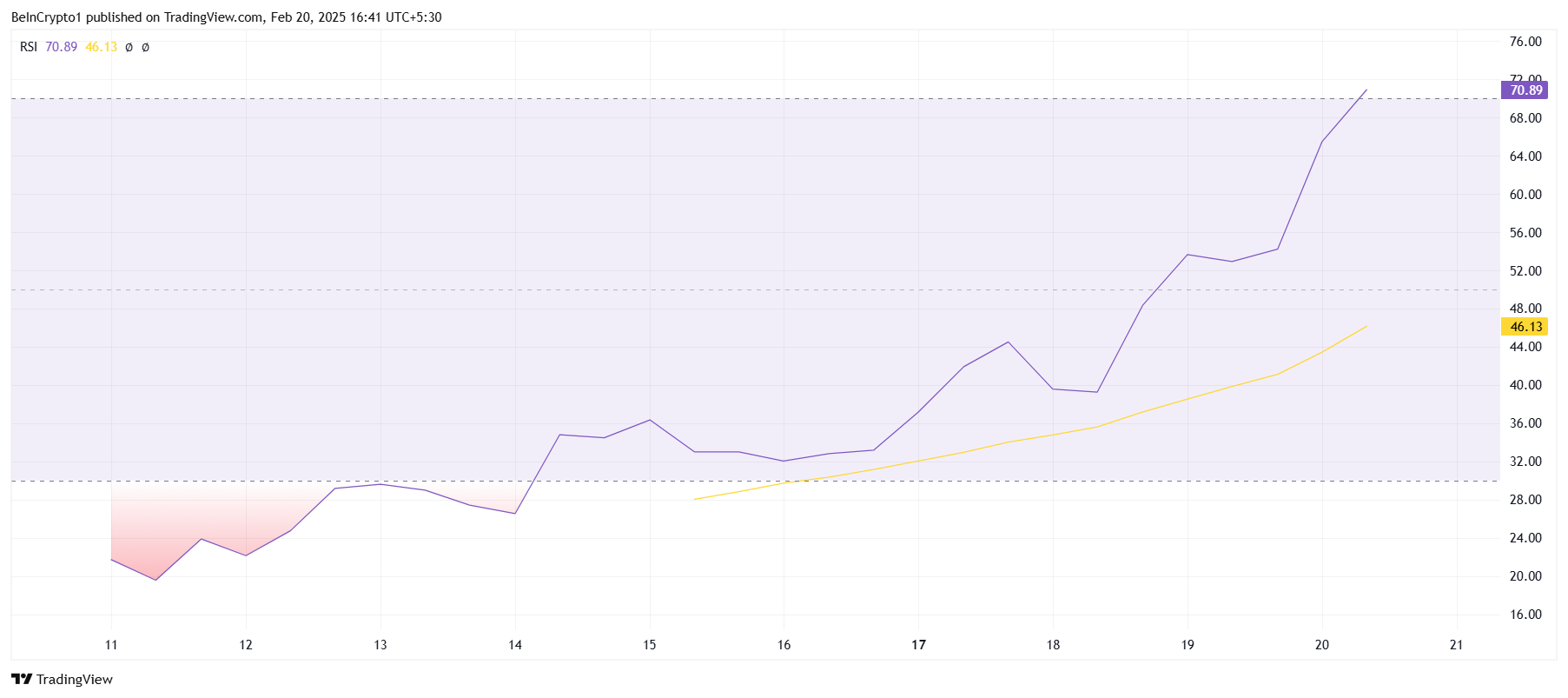

From a technical standpoint, BERA’s macro momentum presents warning signs. The Relative Strength Index (RSI) has entered the overbought zone, crossing the 70.0 threshold. Historically, such levels have preceded price corrections, as traders take profits and momentum slows.

If the RSI sustains its position in this territory, selling pressure could emerge, leading to a potential price reversal. While bullish sentiment remains intact for now, technical signals suggest a possible downturn if buying volume does not support further gains.

BERA Price May Not Make A New High

Currently, BERA trades at $8.13, attempting to overcome resistance at $8.72. The altcoin is also working to solidify $7.71 as a crucial support level. Holding above this price would strengthen bullish sentiment, potentially paving the way for further gains.

However, prevailing market conditions indicate a bearish outlook. The combination of negative funding rates and overbought RSI levels suggests that BERA may struggle to sustain its uptrend. A failure to maintain support at $7.71 could see the altcoin testing lower levels, with $7.07 acting as the next significant support. If selling pressure increases, a further decline toward $6.24 is possible.

On the other hand, if broader market momentum remains bullish, BERA could defy expectations. A successful breach of the $8.72 resistance would set the stage for a retest of its all-time high at $9.23.

In such a scenario, the bearish thesis would be invalidated, and continued buying pressure could push BERA into price discovery mode.

The post BERA’s Price Recovery Sparks Hope, But Negative Sentiment Looms appeared first on BeInCrypto.

Read more