Banana Gun Price Rallies 44% After Major Selling, Profit Taking Still Likely

Banana (BANANA) has recently seen a price rally, gaining 44% as it attempts to break out of a descending wedge pattern. While this bullish setup suggests the potential for further gains, investors’ behavior could hinder the altcoin’s progress.

Despite the price rise, many investors are reluctant to hold, potentially delaying the breakout.

Banana Gun Faces Selling

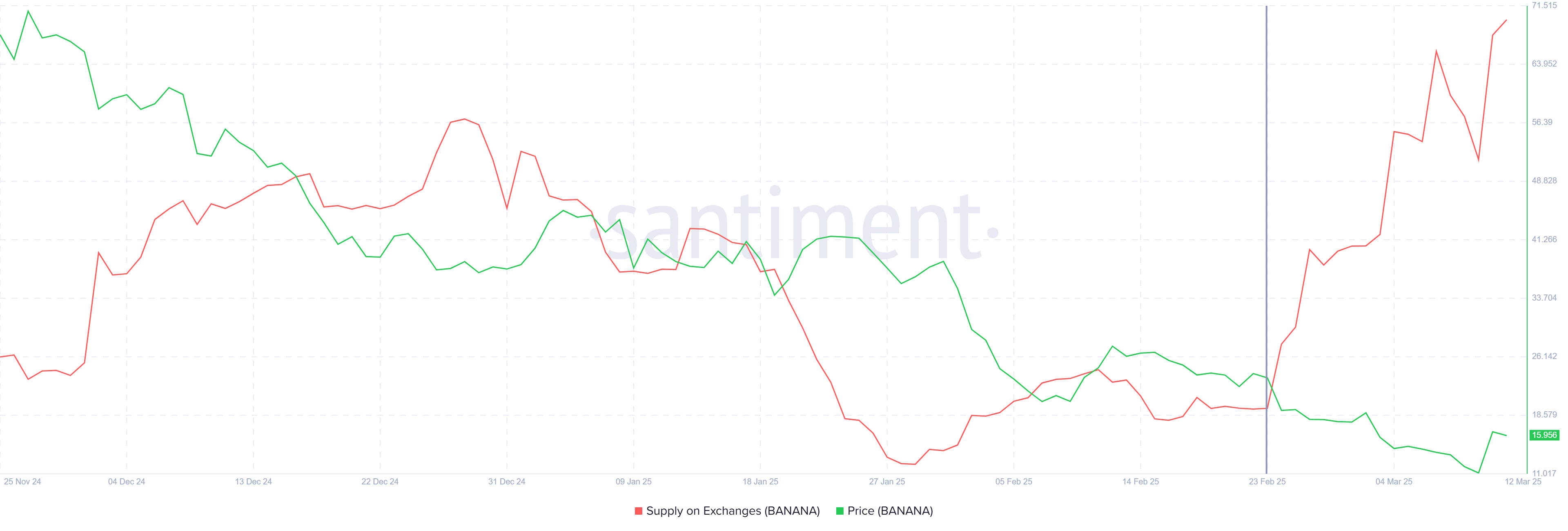

Over the past two weeks, the supply of Banana on exchanges has risen by 300,000 tokens, worth just under $5 million. This increase in selling pressure amounts to roughly 9% of the entire market cap, which stands at $55 million. The growing supply on exchanges is a direct result of the altcoin failing to sustain its recovery, pushing many investors to sell and lock in profits.

This increased selling activity points to a highly bearish sentiment surrounding Banana. The failure to recover has triggered a wave of profit-taking, further weighing on the price.

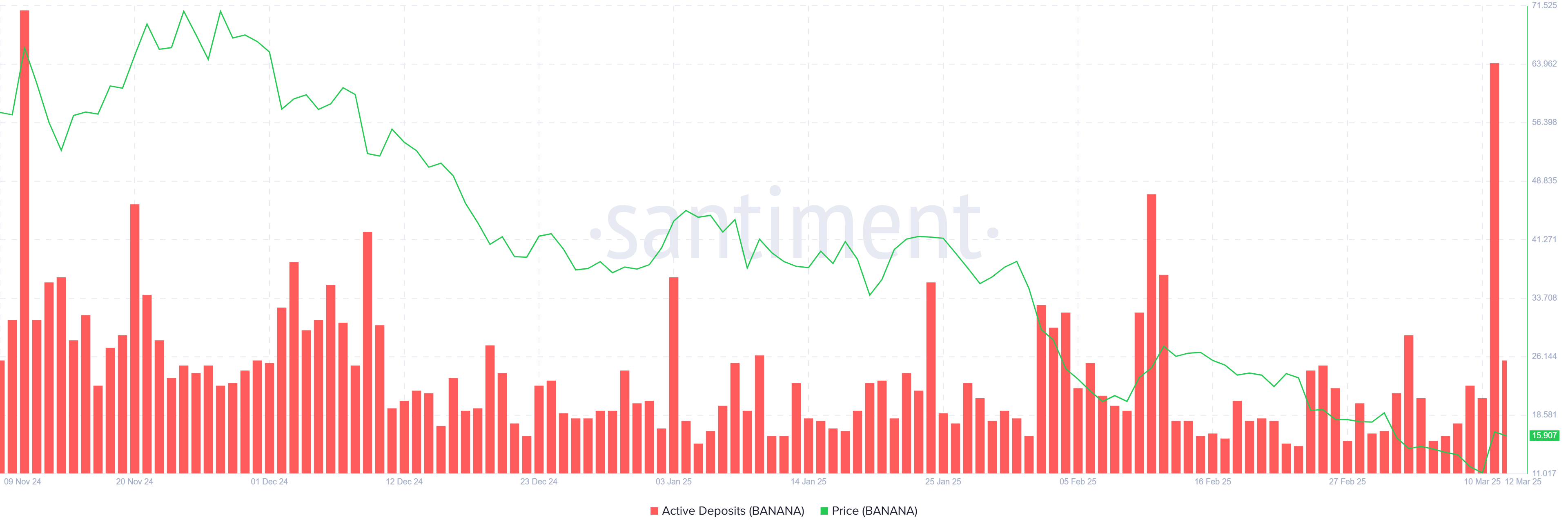

The overall macro momentum for Banana has been marked by a significant spike in active deposits over the past 24 hours, the highest since November 2024. This surge indicates that more Banana tokens are being offloaded, reflecting investor sentiment and profit-taking behavior.

Unlike previous selling periods where investors sought to offset losses, this round of selling appears to be driven by those booking profits. This shift in behavior could signal further selling in the short term, particularly if the price stabilizes or continues to rise.

BANANA Price Is Looking For A Gap

At the moment, Banana is trading at $15.95 after rising by 44% over the past day, sitting within a descending wedge pattern that typically signals bullish potential. However, despite this setup, the altcoin has struggled to break out in the last 24 hours, leaving its future uncertain.

If the current weak momentum and selling trends persist, Banana will likely test the lower trend line of the pattern. This could push the price down to $10.29, delaying any potential recovery and reinforcing the bearish outlook.

On the other hand, if broader market conditions improve and investor sentiment shifts, Banana could see a breakout from the wedge pattern. Successfully breaching the $17.57 barrier would signal a reversal and could send the price towards $23.24. Such a move would invalidate the current bearish outlook and mark the beginning of a stronger upward trend for Banana.

The post Banana Gun Price Rallies 44% After Major Selling, Profit Taking Still Likely appeared first on BeInCrypto.

Read more