Whales Can Derail The Midnight Express Despite Retail Support — $0.10 Is Critical Now

Midnight (NIGHT), the Cardano-linked privacy project, is down about 6% in seven days but up nearly 7% in the past 24 hours. This split week reflects a deeper conflict on the chart and on-chain. Retail optimism is visible. Mega whales are unloading supply at a pace that can derail the move unless the Midnight price reclaims $0.101 with strength.

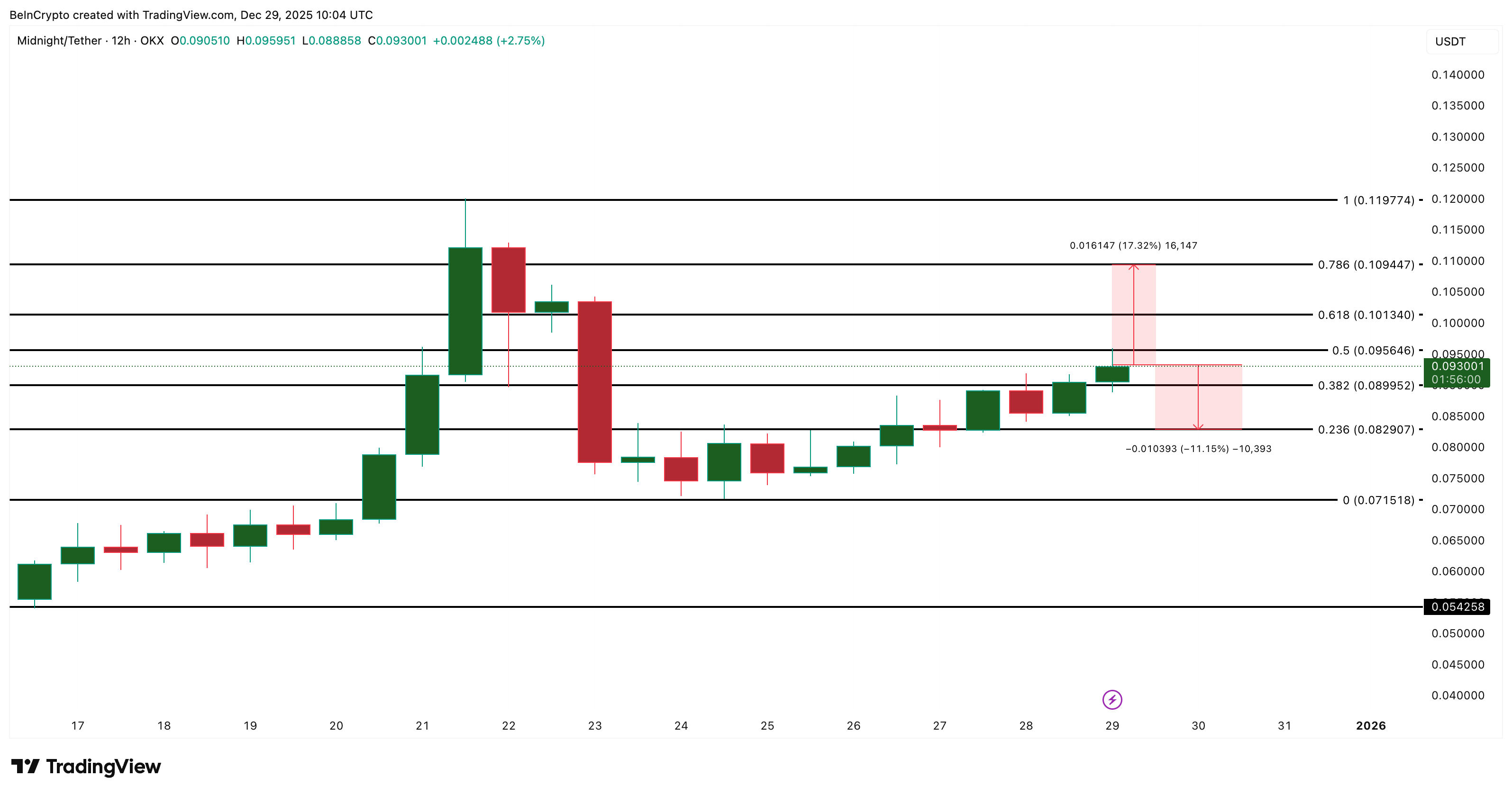

Price action sits near $0.093. The trend stays fragile until clear validation arrives.

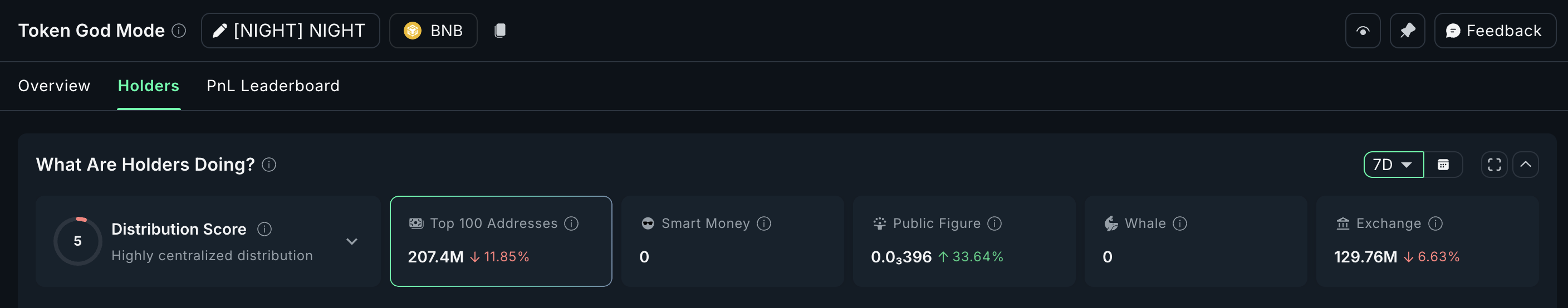

Mega Whales Sell While Retail Buys The Dip

On the BNB Chain, the top 100 NIGHT holders (mega whales) have reduced their balances by 11.85%. Their holdings fell to 207.4 million NIGHT, down by 27.9 million NIGHT. At the current price, that is roughly $2.7 million in value exiting wallets. This positioning turns sentiment against continuation.

Exchange balances tell the opposite story. NIGHT on exchanges fell 6.63% over seven days, now at 129.76 million NIGHT. That decrease equals about 9.2 million NIGHT, or roughly $920,000 in retail-led accumulation. Retail is buying dips, but the size difference favors mega whales by almost three times.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This retail bid is visible on the chart. On-Balance Volume (OBV), which tracks buying pressure using volume direction, has made a higher high and broken its trendline. That divergence formed while the Midnight price made lower highs between December 21 and December 29. It shows retail accumulation pushing against whale selling.

For now, retail momentum is visible, but mega whale outflows still outweigh it.

Derivatives Show Long Bias, But A Trap Zone Exists

Derivatives reflect the same split.

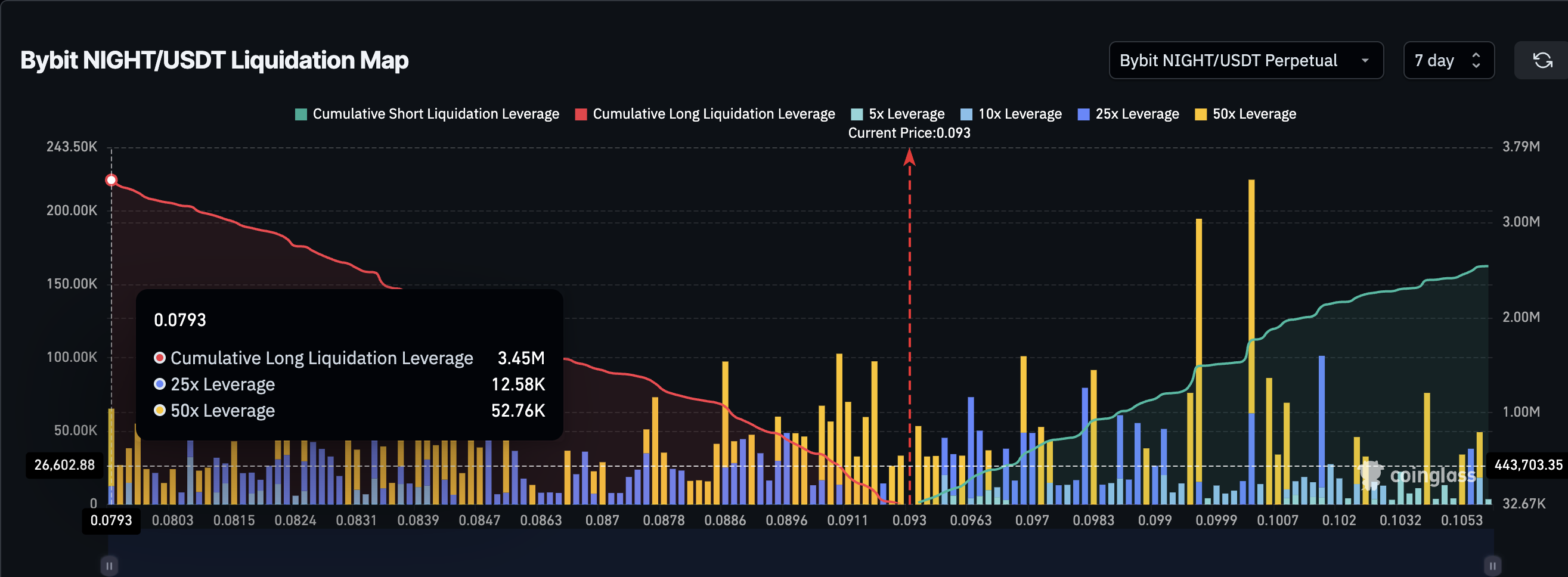

On Bybit, NIGHT-USDT perpetuals show about $3.45 million in long liquidation leverage versus $2.54 million in shorts. Longs make up nearly 57% of liquidation exposure. This matches the retail sentiment but creates vulnerability if the NIGHT price pulls back.

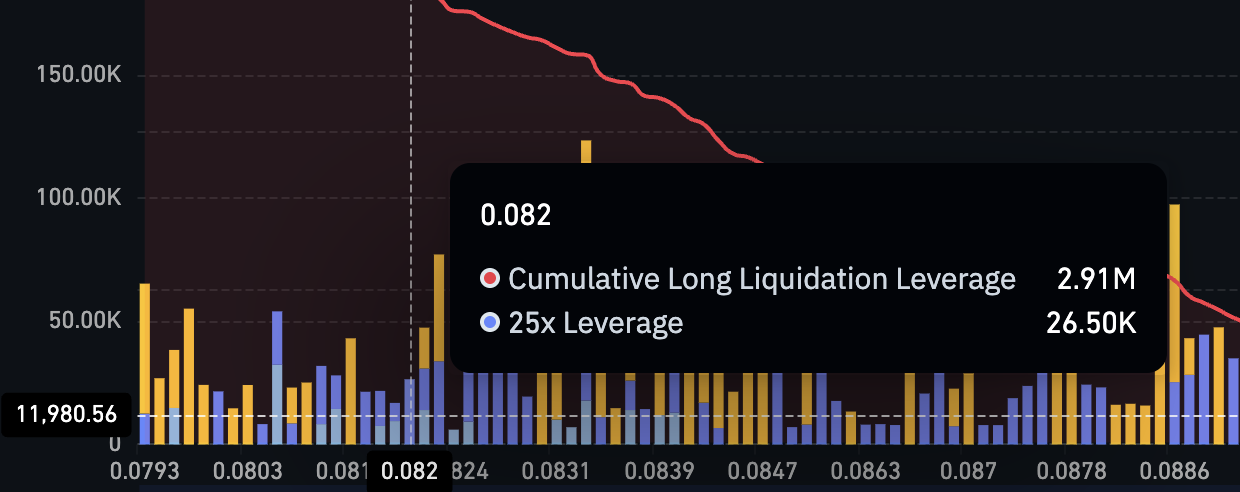

The liquidation map highlights a danger zone at $0.082. If NIGHT drops near that area (also visible on the price chart), almost $2.91 million of long positions face forced closing. This exceeds 84% of the current long liquidation cluster. Such an unwind would intensify selling pressure and likely accelerate the downside.

As long as mega whales continue to sell while the derivatives remain long, downside risk remains higher than most retail traders may expect.

Midnight Price Levels Decide What Happens Next

Midnight (NIGHT) trades near $0.093. Reclaiming $0.101 tests the 0.618 Fibonacci level, a psychological line. A daily close above $0.109 confirms momentum. That sets up an attempt at $0.119, where price enters a fresh discovery zone for this range. Above that, the trend has reason to extend, and mega whale selling would need to slow for continuation.

If price fails to reclaim $0.101, mega whale pressure can steer the trend lower. Losing $0.082 triggers liquidation clusters and opens the path to $0.071. That becomes the invalidation zone for any near-term recovery.

For now, the Midnight price sits between retail optimism and mega whale distribution. One side will decide the direction soon. If NIGHT cannot secure $0.101 ($0.10 per the title), the Midnight Express could derail before the market sees a larger breakout.

The post Whales Can Derail The Midnight Express Despite Retail Support — $0.10 Is Critical Now appeared first on BeInCrypto.

Read more