ETH Price Could Dip Below $1,500 as Ethereum ETFs Suffer Record Outflows

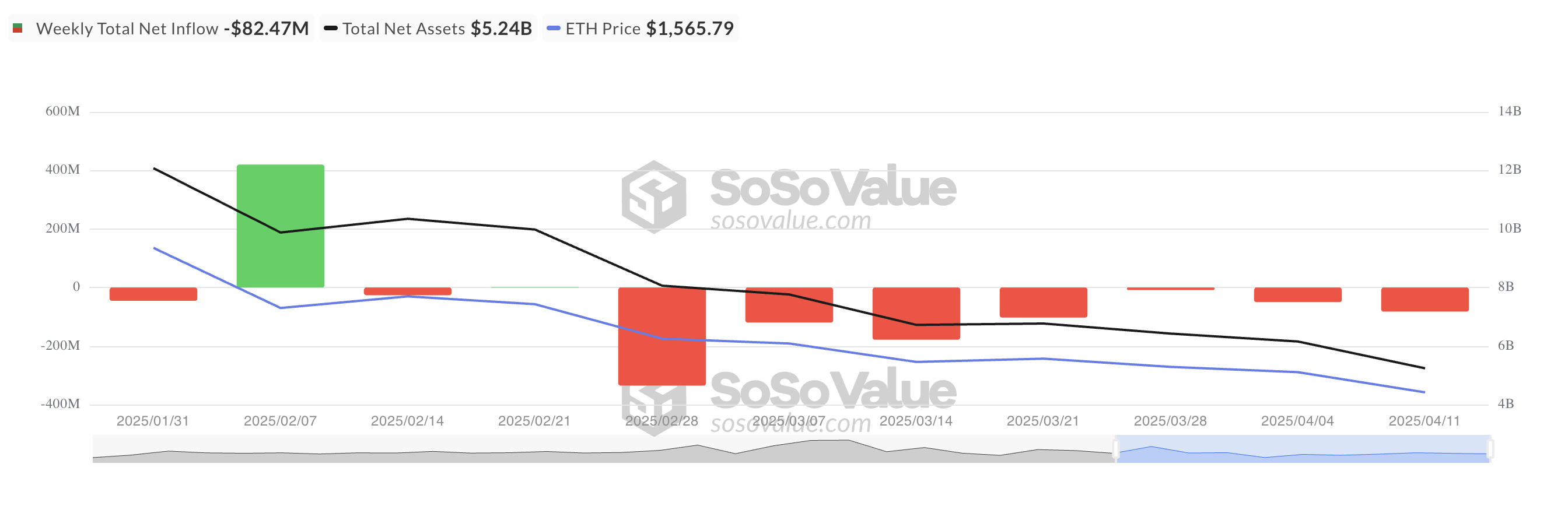

Ethereum ETFs have closed yet another week in the red, recording net outflows amid continued investor hesitation.

Notably, there has been no single week of net inflows since the end of February, highlighting waning institutional interest in ETH-related products.

Ethereum ETFs Face Steady Outflows

Ethereum-backed ETFs have recorded their seventh consecutive week of net outflows, highlighting sustained institutional hesitance toward the asset.

This week alone, net outflows from spot ETH ETFs totaled $82.47 million, marking a 39% surge from the $49 million recorded in outflows the previous week.

With the steady decline in institutional presence in the ETH market, the selling pressure on the coin has soared.

Over the past week, ETH’s price has declined by 11%. The steady outflows from the funds backed by the coin suggest that the downward momentum may persist, increasing the likelihood of a price drop below the $1,500 mark.

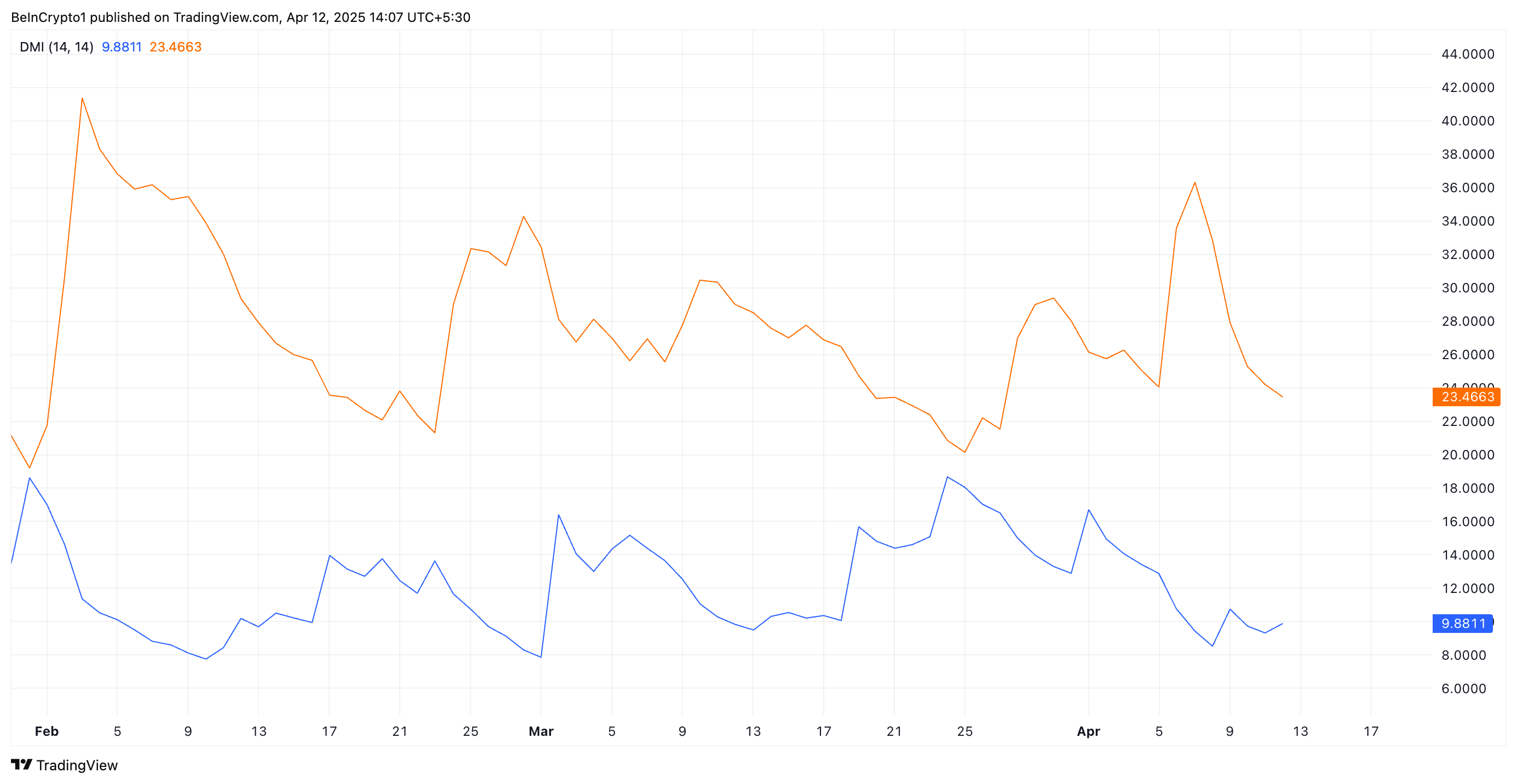

On the price chart, technical indicators remain bearish, confirming the mounting pressure from the selling side of the market. For example, at press time, readings from ETH’s Directional Movement Index (DMI) show its positive directional index (+DI) resting below the negative directional index (-DI).

The DMI indicator measures the strength of an asset’s price trend. It consists of two lines: the +DI, which represents upward price movement, and the -DI, which represents downward price movement.

As with ETH, when the +DI rests below the -DI, the market is in a bearish trend, with downward price movement dominating the market sentiment.

Ethereum’s Price Could Drop Below $1,500

The lack of institutional capital could delay any significant rebound in ETH price, further dampening short-term prospects for recovery. If demand leans further, ETH could break out of its narrow range and follow a downward trend.

The altcoin could fall below $1,500 in this scenario to reach $1,395.

However, if ETH witnesses a positive shift in sentiment and demand spikes, its price could climb to $2,114.

The post ETH Price Could Dip Below $1,500 as Ethereum ETFs Suffer Record Outflows appeared first on BeInCrypto.

Read more