Analysts Predict Major Bitcoin Rally in Late March as M2 Money Supply Grows

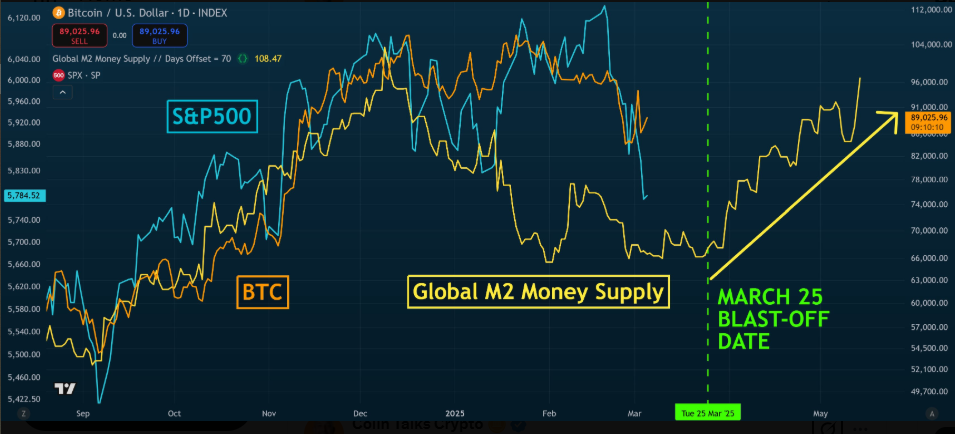

Recent analyses by crypto experts acknowledge that Bitcoin (BTC) price movements closely correlate with the global M2 money supply. Based on this, they predict potential bullish momentum for the crypto market in late March.

With global liquidity expanding, analysts predict that Bitcoin and other digital assets could experience a significant rally, starting around March 25, 2025, and potentially lasting until mid-May.

Global M2 and Its Influence on Bitcoin

The M2 money supply represents a broad measure of liquidity, including cash, checking deposits, and easily convertible near-money assets. Historically, Bitcoin has demonstrated a strong correlation with M2 fluctuations, as increased liquidity in financial markets often drives demand for alternative assets like cryptocurrencies.

Colin Talks Crypto, an analyst on X (Twitter), highlighted this correlation, pointing to a sharp increase in global M2. He described it as a “vertical line” on the chart, signaling an imminent surge in asset prices.

According to his prediction, the rally for stocks, Bitcoin, and the broader crypto market is expected to commence on March 25, 2025, and extend until May 14, 2025.

“The Global M2 Money Supply chart just printed another vertical line. The rally for stocks, Bitcoin, and crypto is going to be epic,” he suggested.

Vandell, co-founder of Black Swan Capitalist, supports that global M2 movements directly influence Bitcoin’s price. He notes that declines in global M2 are typically followed by Bitcoin and cryptocurrency market downturns about ten weeks later.

Despite the potential for short-term dips, Vandell believes this cycle sets the stage for a long-term uptrend.

“As seen recently, when global M2 declined, Bitcoin & crypto followed roughly 10 weeks later. While further downside is possible, this drawdown is a natural part of the cycle. This liquidity shift will likely continue throughout the year, setting the stage for the next leg up,” Vandell explained.

Similarly, another popular analyst, Michaël van de Poppe, sees M2 expansion as one of five key indicators for an early market recovery. He emphasizes that with inflation no longer the primary focus and expectations of US Federal Reserve rate cuts, financial conditions are becoming more favorable for Bitcoin.

“Bottom line is: Inflation isn’t the prime topic, likely to go down. FED rate cuts. The dollar to weaken massively. Yields to fall. M2 Supply to significantly expand. And as this process started, it’s just a matter of time until altcoins and crypto pick up. Bull,” he stated.

Historical Context and Projections

The correlation between Bitcoin’s price and global M2 growth is not new. Tomas, a macroeconomist, recently compared previous market cycles, particularly in 2017 and 2020. At the time, significant increases in global M2 coincided with Bitcoin’s strongest annual performances.

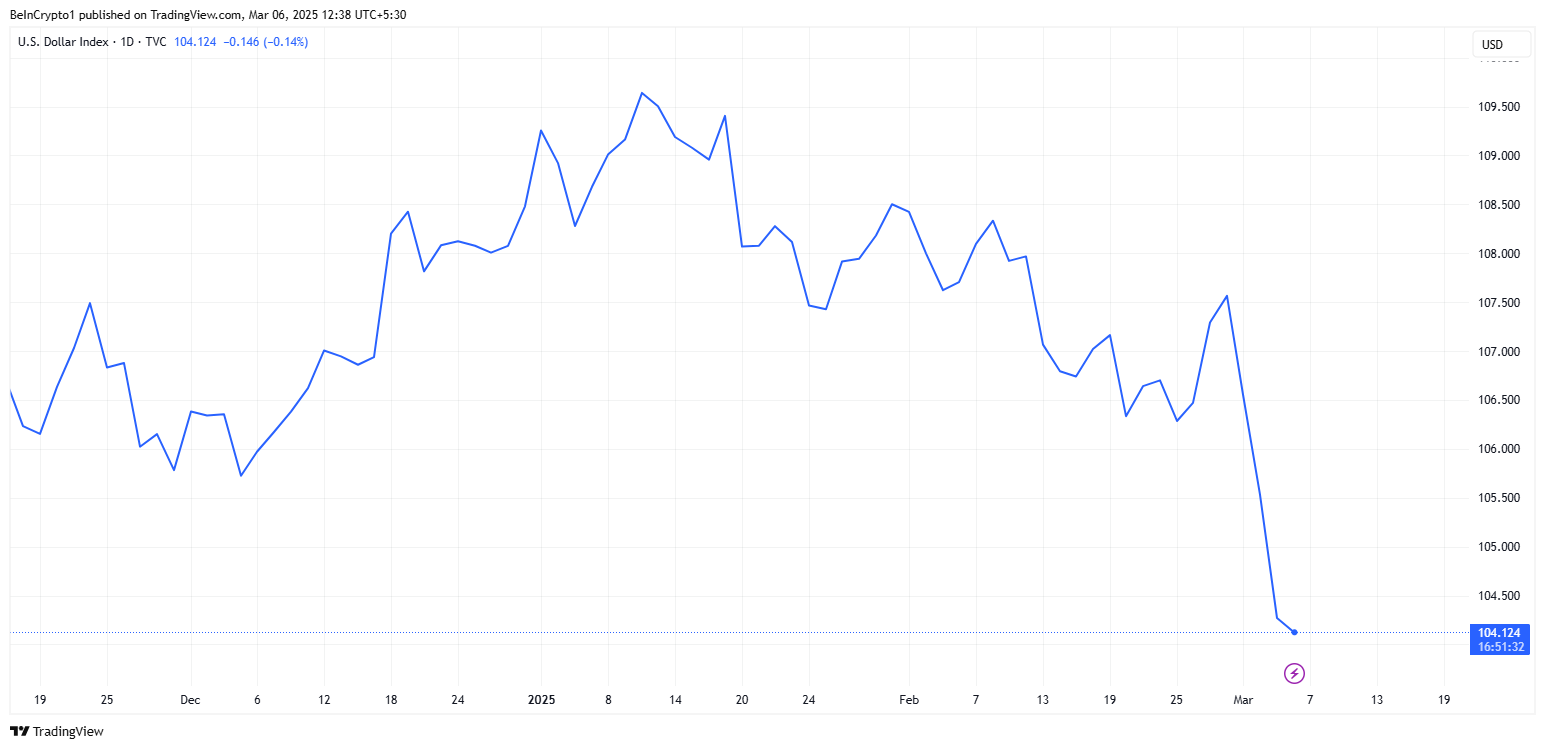

“Money supply is expanding globally. The last two major global M2 surges occurred in 2017 and 2020—both coincided with mini ‘everything bubbles’ and Bitcoin’s strongest years. Could we see a repeat in 2025? It depends on whether the U.S. dollar weakens significantly,” Tomas observed.

Tomas also highlighted the impact of central bank policies, pointing out that while major banks are cutting rates, the strength of the US dollar could be a limiting factor. If the dollar index (DXY) drops to around 100 or lower, it could create conditions similar to previous Bitcoin bull runs.

The Federal Reserve’s Role

Macro researcher Yimin Xu believes that the Federal Reserve might halt its Quantitative Tightening (QT) policies in the latter half of the year. Such a move, Yimin says, could potentially shift toward Quantitative Easing (QE) if economic conditions demand it. This shift could inject additional liquidity into the markets, fueling Bitcoin’s upward trajectory.

“I think reserves could get too thin for the Fed’s liking in the second half of the year. I predict they will terminate QT in late Q3 or Q4, with possible QE to come after,” Xu commented.

Tomas agreed, stating that the Federal Reserve’s current plan is to increase its balance sheet slowly, which is in line with GDP growth. He also articulates that a major financial event could trigger a full-scale return to QE.

These perspectives suggest that uncertainties remain, including the strength of the US dollar and potential economic shocks. Nevertheless, the broader consensus among analysts points toward an impending bullish phase for Bitcoin.

Investors must conduct their own research as they continue to watch macroeconomic indicators in the coming months, anticipating whether the predicted rally will materialize.

The post Analysts Predict Major Bitcoin Rally in Late March as M2 Money Supply Grows appeared first on BeInCrypto.

Read more