MYX Finance Lost 70% In a Week: What Triggered the Sharp Sell-Off?

MYX Finance has posted one of the steepest weekly drawdowns in the digital asset market. The token plunged 72% over the past seven days, underperforming most comparable altcoins. The sell-off erased months of gains and pushed MYX to a three-month low.

At first glance, such a collapse often signals protocol failure or declining utility. However, on-chain data and derivatives metrics tell a different story.

MYX Finance Is Still Doing Well In The DeFi Space

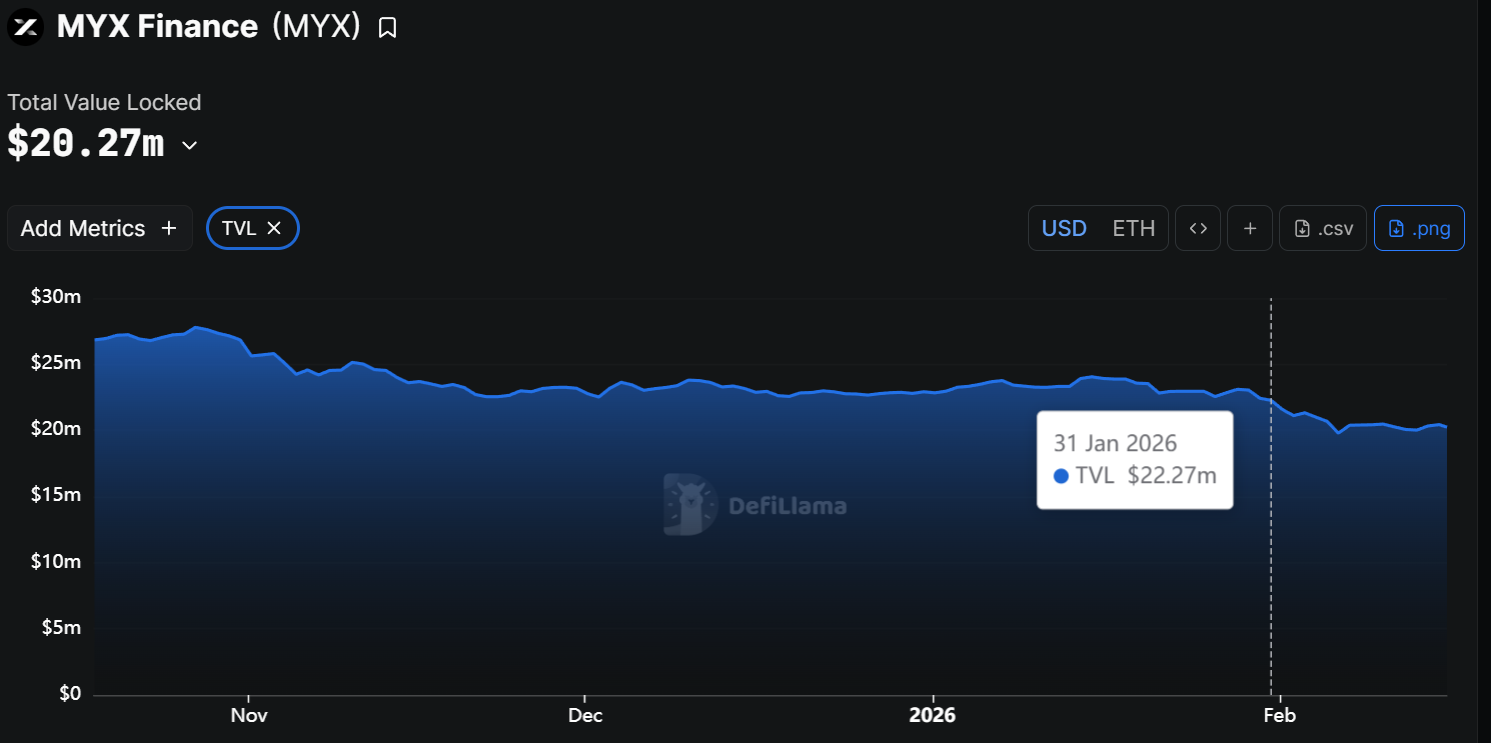

A sharp decline typically raises concerns about weakening demand or user migration. Investors often examine total value locked, or TVL, to assess platform health. In decentralized finance, TVL measures the amount of capital secured within a protocol’s smart contracts.

MYX Finance’s TVL declined by roughly $2 million since the start of the month. It fell from $22.27 million on January 31 to $20.27 million today. While the drop reflects some capital outflow, it does not indicate a systemic collapse. The reduction represents less than 10% of the total locked value.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This moderate contraction suggests that users have not exited en masse. Core utility appears intact. The data imply that the price crash was not driven by a dramatic fall in platform adoption.

Traders Are Pining For MYX Price Drop

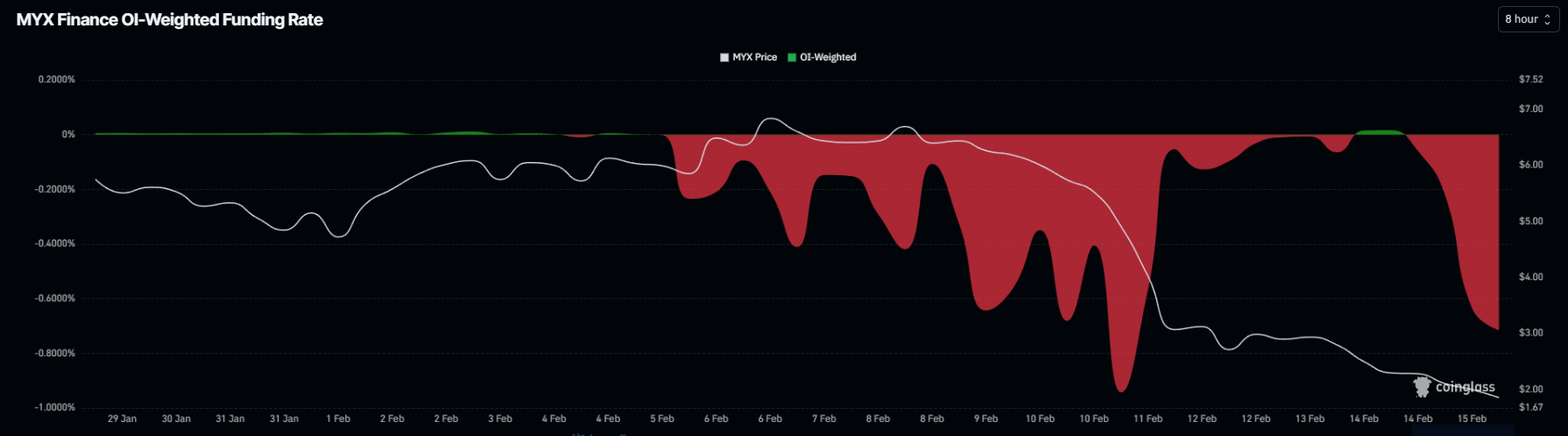

Derivatives data provides stronger insight into the recent volatility. Funding rates in perpetual futures markets reveal whether traders are leaning long or short. When funding turns deeply negative, short sellers dominate and pay fees to long holders.

MYX has experienced persistently negative funding rates, with spikes reflecting intense bearish pressure. This pattern shows traders have been aggressively opening short contracts. The imbalance suggests speculation on continued downside rather than a reaction to deteriorating fundamentals.

Such positioning can accelerate price movements. Heavy short exposure amplifies downward momentum during periods of fear. In MYX’s case, sustained negative funding indicates that sentiment, not utility loss, has driven much of the decline.

How Are MYX Holders Acting?

The Money Flow Index, or MFI, further supports this view. The MFI tracks capital inflows and outflows by combining price and volume. A move below the neutral 50 level signals strengthening selling pressure.

MYX’s MFI has fallen beneath that midpoint, confirming that MYX sellers currently control momentum. The shift reflects growing fear, uncertainty, and doubt among traders. As liquidity thins, price declines can intensify quickly.

Historical patterns offer additional context. The last time MYX’s MFI moved decisively from buying to selling pressure, the token dropped 50%. This time, the decline has already reached 72%. The trend may continue until the MFI approaches the oversold zone, where selling pressure typically begins to exhaust.

MYX Price Crashes

MYX is trading at $1.88 at the time of writing. The token broke below the psychological $2.00 level, marking its lowest price in three months. The 72% weekly decline reflects extreme short-term weakness and heightened volatility.

If MYX fails to hold the $1.68 support level, additional downside risk increases. A breakdown could push the token toward $1.43. Losing that support would expose the next critical level near $1.22, where buyers may attempt to stabilize price action.

Conversely, sentiment shifts can occur quickly in crypto markets. If investors view current levels as undervalued, accumulation could begin. A sustained move above $2.48 would signal improving strength. Reclaiming that level as support could invalidate the bearish outlook as MYX approaches the $3.00 mark.

The post MYX Finance Lost 70% In a Week: What Triggered the Sharp Sell-Off? appeared first on BeInCrypto.

Read more