Tether Nets Record Profit as US Debt Hoard Hits $141 Billion

Tether, the controversial but dominant backbone of the digital asset market, reported a staggering $10 billion net profit for 2025.

The results underscore a year of aggressive expansion, transforming the stablecoin issuer into one of the world’s largest private holders of US government debt.

$50 Billion USDT Expansion Fuels Record Profits

The profit, which Tether claims emanated solely from its core stablecoin business, coincides with a massive $50 billion injection of liquidity into the crypto ecosystem.

This issuance pushed the total USDT in circulation above $186 billion. It is the second-largest annual expansion in the company’s decade-long history.

“USDT expanded throughout the year by 50 billion, because global demand for dollars is increasingly moving outside traditional banking rails, particularly in regions where financial systems are slow, fragmented, or inaccessible. USDT, with its network effect and parabolic growth, has become the most widely adopted monetary social network in the history of humanity.” Tether CEO Paolo Ardoino said.

While Tether maintains a $20 billion venture portfolio across sectors such as AI and biotech, those high-risk bets were not the drivers of this year’s windfall. Instead, the profit was a byproduct of the “higher-for-longer” interest rate environment.

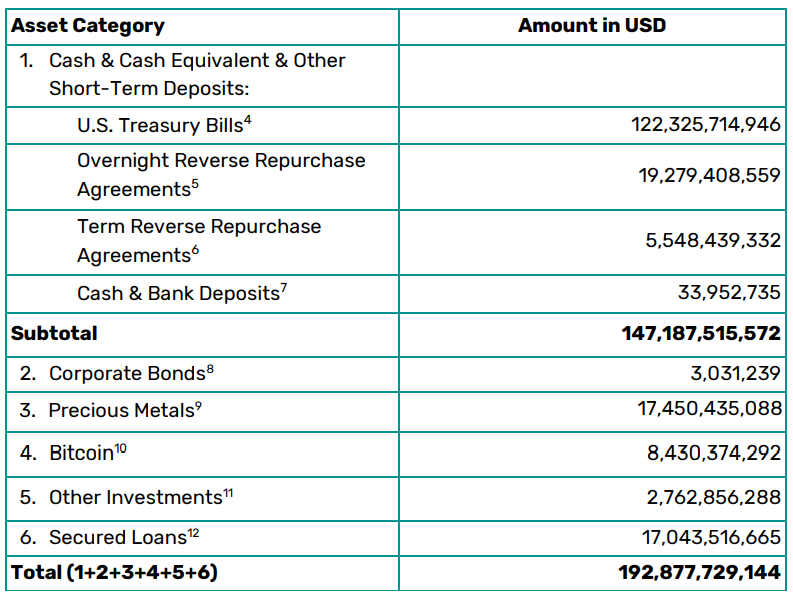

Meanwhile, Tether’s balance sheet now rivals major sovereign nations. The firm’s total reserve assets climbed to a record $193 billion, supported by a massive $141 billion exposure to US Treasuries (both direct and indirect).

This $141 billion figure places Tether among the top global creditors to the US government, a reality that has drawn both investor admiration and scrutiny from Washington.

This growth comes with increased systemic risk as the company still lacks an audit from a “Big Four” accounting firm.

Consequently, critics continue to question the true liquidity of its $17.4 billion in gold and $8.4 billion in Bitcoin holdings during a market crunch. Nonetheless, the firm maintains that it still has over $6.3 billion in excess reserves.

Tether’s Regulatory Hurdles

The financial triumph is currently being shadowed by a widening regulatory rift. In Europe, USDT continues to operate without a license under the Markets in Crypto-Assets (MiCA) framework.

More critically, the passing of the GENIUS Act in the United States has rendered USDT “unqualified” for domestic use.

In a defensive maneuver to protect its American interests, Tether has launched USAT. This is a separate onshore asset specifically designed to comply with US federal mandates.

This bifurcated strategy—using USDT for global “shadow banking” and USAT for regulated U.S. commerce—marks a pivotal transition in Tether’s attempt to achieve “too big to fail” status.

Despite these hurdles, USDT maintains a 60.5% market share. For now, Tether remains the undisputed leader in liquidity, even as global regulatory walls begin to close in.

The post Tether Nets Record Profit as US Debt Hoard Hits $141 Billion appeared first on BeInCrypto.

Read more