XRP Price Faces a 25% Crash Warning as ETF Demand Falls

The XRP price is sitting in a dangerous spot. At around $1.89, XRP is trading just 1% above a key breakdown zone. On the surface, the chart looks calm. Underneath, several signals suggest risk is quietly building. What makes this setup unusual is not just the proximity to support. It is what failed to happen earlier.

XRP recently printed a bullish signal that usually leads to at least a short-term rebound. This time, it barely moved. That failure is the real warning.

Hidden Bullish Divergence Failed — A Red Flag?

Between December 31 and January 20, the XRP price formed a hidden bullish divergence on the daily chart. Price made a higher low, while the Relative Strength Index (RSI) printed a lower low.

A hidden bullish divergence usually signals that selling pressure is weakening and that buyers may soon regain control. It does not guarantee a rally, but it often leads to a bounce or at least a period of upside relief.

That did not happen here.

After the divergence flashed, XRP barely moved higher. Price stalled, and momentum never expanded. This tells us something important. Sellers may have slowed down, but buyers did not step in to replace them.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This kind of divergence failure often appears in weak markets. It shows hesitation, not strength. When a bullish signal fails, it usually means demand is missing, not that the signal was wrong.

The rising XRP wedge structure still points to a possible 25% downside move if support breaks. With buyers absent and sellers slowly regaining control, XRP is approaching a moment when even a modest downside move could trigger a much larger move.

Also, if buyers do not show up after the selling pressure eases, what happens when sellers return?

ETF Flows and Holder Data Confirm Demand Is Weakening

The answer starts with capital flows.

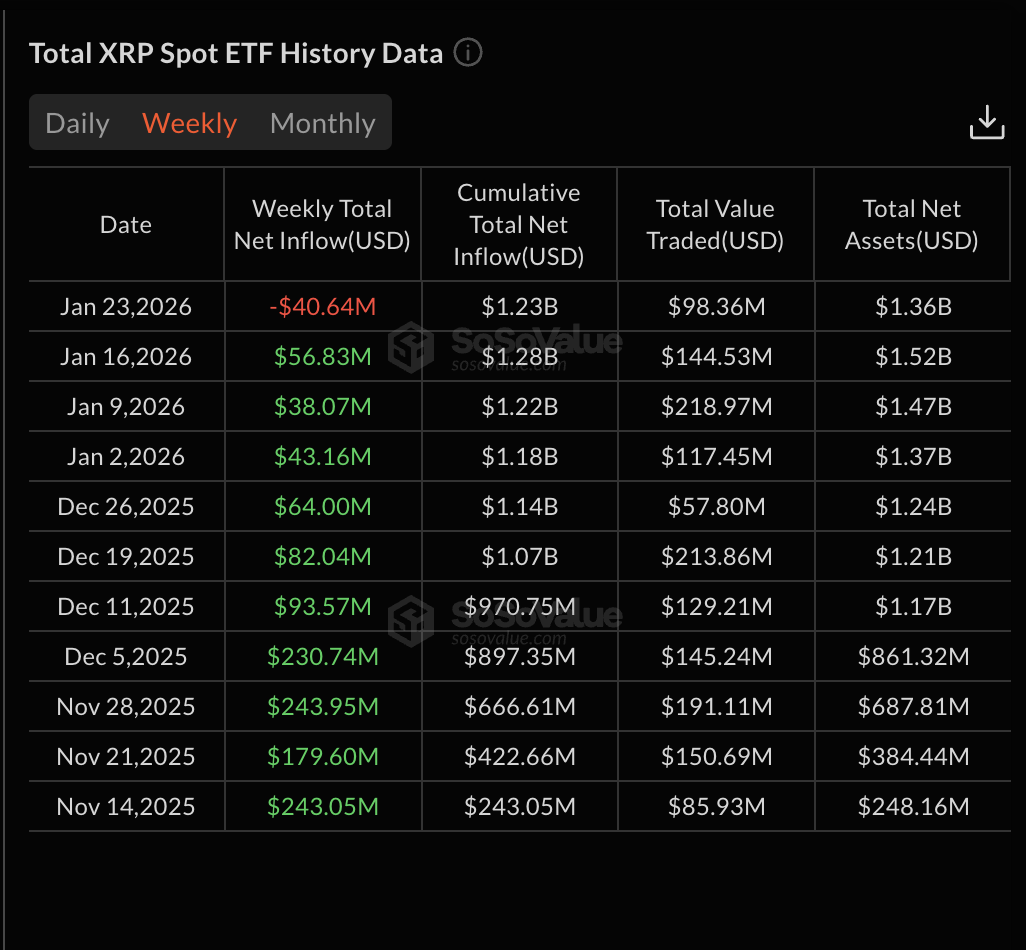

For the first time in weeks, XRP-related ETF products recorded net outflows. The week ending January 23 saw a total outflow of roughly $40.5 million. This came after a long stretch of steady inflows, making it a clear shift in behavior.

ETF flows matter because they reflect large, directional capital. When inflows stop and turn negative, it usually means institutional demand is pausing or stepping back.

On-chain data tells a similar story.

The XRP Hodler Net Position Change metric, which tracks the monthly balance change of long-term holders, has flattened and begun to slip. On January 20, long-term holders controlled roughly 232.1 million XRP. By January 24, that figure had dropped to about 231.55 million XRP.

This is not aggressive selling, but it is not accumulation either. After the divergence flashed, long-term holders did not add meaningfully. That confirms what the price action already suggested. Buyers were not confident enough to commit.

When ETF demand stalls and long-term holders pause at the same time, rebounds tend to struggle.

Whale Selling Keeps XRP Price Breakdown Risk Alive

While buyers hesitated, one group did act.

Wallets holding between 10 million and 100 million XRP began reducing exposure. On January 18, this cohort held roughly 11.16 billion XRP. By the latest reading, their balance had dropped to about 11.07 billion XRP.

That is a reduction of around 90 million XRP. At the current XRP price, this represents roughly $170 million worth of distribution.

This selling pressure also helps explain why XRP failed to react to the hidden bullish divergence. It also explains why the price remains pinned near support. From a technical perspective, the risk is now clear.

A daily close below $1.85-$1.86 would break wedge support and activate the downside target. That opens the door toward the $1.70 region first, followed by a deeper move toward $1.42 if momentum accelerates. That would come close to the near 25% breakdown target.

On the upside, XRP needs to reclaim $1.98 to weaken bearish pressure. That would provide short-term relief, but without renewed buyer participation, it would likely remain a bounce rather than a trend shift. Right now, the imbalance is obvious. Selling exists. Buyers do not.

The post XRP Price Faces a 25% Crash Warning as ETF Demand Falls appeared first on BeInCrypto.

Read more