Binance and OKX To Enter TradFi With Tokenized Stocks

Major crypto exchanges Binance and OKX are reportedly exploring the reintroduction of tokenized US stocks.

The move marks a strategic pivot to capture traditional finance (TradFi) yields amid stagnant crypto trading volumes, pushing platforms toward diversification into real-world assets (RWAs).

A Return to Tokenized Stocks?

This move revives a product Binance tested and abandoned in 2021 due to regulatory hurdles. Nevertheless, it would position the exchanges to compete in a fast-growing but still nascent tokenized equities market.

In April 2021, Binance launched stock tokens for major names like Tesla, Microsoft, and Apple, issued by German broker CM-Equity AG with Binance handling trading.

The service was discontinued in July 2021 under pressure from regulators, including Germany’s BaFin and the UK’s FCA. Regulators viewed the products as unlicensed securities offerings lacking proper prospectuses.

Binance cited a shift in commercial focus at the time. However, recent reports from The Information indicate Binance is now considering a relaunch for non-US users to sidestep SEC oversight, creating a parallel 24/7 market.

Reportedly, OKX is also weighing similar offerings as part of the exchange’s RWA expansion. No official confirmations have emerged from either exchange, and details on issuers, exact listings, or timelines remain limited.

Citing a Binance spokesperson, the report described exploring tokenized equities as a “natural next step” in bridging TradFi and crypto.

Why Crypto Exchanges Want US Equities Now

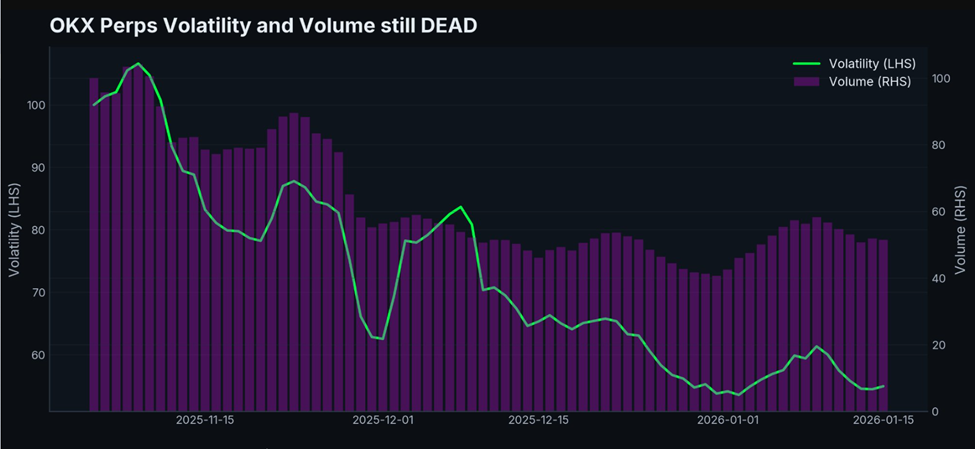

Crypto markets have experienced persistent stagnation in trading volume in 2026, prompting exchanges to seek new revenue streams.

“BTC spot trading activity remains constrained so far in 2026: Average daily spot volumes for January tracking 2% below December and 37% below November levels,” wrote researcher David Lawant in a recent post.

Analysts also note that Crypto markets remain largely dormant in January, with volatility and trading volume pinned near December’s graveyard lows.

This is not calm consolidation but a liquidity trap, where thin order books amplify risk and a single poor execution can cascade into outsized losses for overexposed traders.

Meanwhile, US tech stocks (Nvidia, Apple, Tesla) have sustained strong rallies, driving demand among crypto holders, particularly those with stablecoin balances, for equity exposure without exiting the ecosystem.

Tokenized stocks allow 24/7 trading of synthetic assets that mirror underlying share prices, often backed by offshore custodians or derivatives rather than direct ownership.

The market, while small, is accelerating. Total tokenized stock value stands at approximately $912 million, with data on RWA.xyz showing it is up 19% month-on-month. Meanwhile, monthly transfer volumes exceed $2 billion, and active addresses are surging.

“I’ve bought NVIDIA on Binance Wallet before. Actually, right now, the top priority for both companies should be how to launch a precious metals market. Especially silver—apart from gold, which is suitable for physical storage, the others don’t have much storage value. I’m in China, and even paper silver is hard to buy; I can only buy ETFs,” one user stated.

Analyst AB Kuai Dong noted that official spot markets remain limited to futures or third-party tokens like PAXG for gold.

Intensifying Competition in Tokenized Assets

This push comes amid a broader race in tokenized real-world assets. Traditional players like NYSE and Nasdaq are seeking approvals for regulated on-chain stock platforms, potentially clashing with offshore crypto-led models in the future.

Robinhood has already captured a significant share in the EU (and EEA), launching tokenized US stocks and ETFs in mid-2025. Crucial metrics from Robinhood’s offerings include:

- Expanded to nearly 2,000 assets with zero commissions,

- 24/5 trading (migrating toward full 24/7 on its planned Layer 2 “Robinhood Chain” built on Arbitrum), and

- Integration into a retail-friendly app.

This targets younger, crypto-savvy users seeking seamless cross-asset access. Binance and OKX’s global scale, massive user bases, and always-on crypto infrastructure position them to challenge Robinhood’s EU dominance and expand into underserved regions (Asia, Latin America).

Their crypto-native audience is primed for tokenized equities as a natural extension, potentially accelerating adoption if launched.

The playing field also features a parallel turf war between Robinhood and Coinbase, both of which are building “everything exchanges” that blend stocks, crypto, prediction markets, and more.

Coinbase’s recent additions (commission-free stocks, prediction markets via Kalshi, derivatives via Deribit acquisition) directly target Robinhood’s retail strengths, while Robinhood counters with deeper crypto features and tokenized assets abroad.

If Binance and OKX proceed, tokenized stocks could serve as a liquidity lifeline, attracting capital back into crypto platforms and bridging TradFi yields.

Success, however, hinges on global regulations, ensuring liquidity and tracking accuracy, and building trust amid past shutdowns.

The post Binance and OKX To Enter TradFi With Tokenized Stocks appeared first on BeInCrypto.

Read more