Strive CIO Explains the Structure That Lets MicroStrategy’s Stock Beat Bitcoin | US Crypto News

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee, settle in, and think beyond the daily price swings of Bitcoin. What if the story isn’t about timing the market, but about how a company’s structure quietly compounds value over the years? That’s the argument Strive CIO Jeff Walton is making about MicroStrategy (MSTR), a stock that, on the surface, moves with crypto, but underneath, he says, operates like a machine steadily increasing Bitcoin exposure per share.

Crypto News of the Day: Strive CIO Jeff Walton on Why Buying MSTR at 2.5x mNAV Still Beats Spot Bitcoin

Jeff Walton, Chief Risk Officer at Strive and founder and CEO of its subsidiary True North, says most investors fundamentally misunderstand MicroStrategy (MSTR).

Reflecting on his own 2021 purchases, Walton argues the stock should not be viewed as a leveraged Bitcoin proxy. Rather, investors should view MSTR as a capital markets engine designed to increase Bitcoin exposure per share over time.

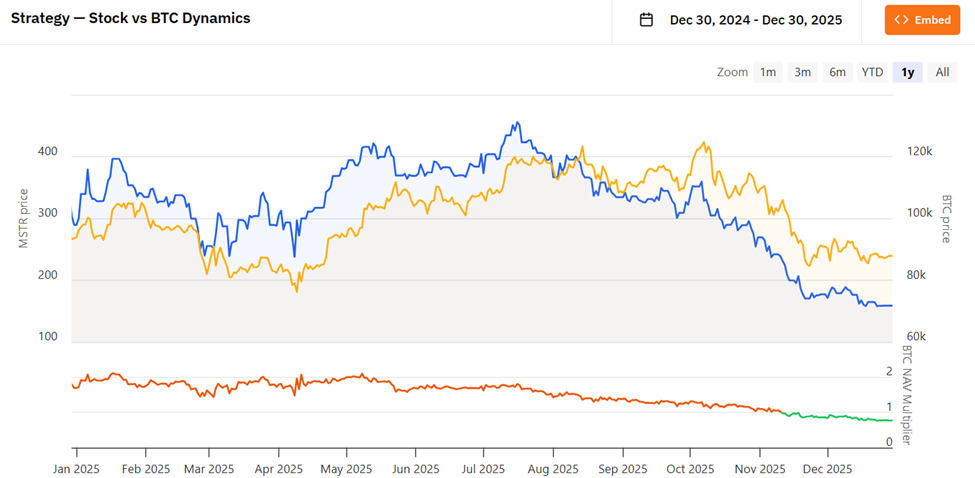

Walton revealed he began buying MSTR in June 2021 at roughly 2.5x mNAV, believing the stock was already down 50%.

“Little did I know, the stock would fall another 80% from my cost basis,” he wrote, as MSTR collapsed nearly 90% from its February 2021 peak.

By late 2022, the company was trading near 1.3x mNAV, holding 129,999 Bitcoin while its notional debt briefly exceeded asset value. Despite being “down bad on paper,” Walton said the underlying math never broke.

“The company had REAL hard money, debt covenants weren’t egregious, and structurally everything on the horizon for crypto was bullish,” he said, citing the halving cycle, ETFs, elections, and interest rate shifts.

By mid-2023, Walton said he went “all in,” convinced the capital structure, not price action, was the real thesis.

That conviction, he argues, is what allowed long-term holders to survive one of the harshest drawdowns in crypto equity history.

How Time and Structure Changed the Risk Equation for MicroStrategy

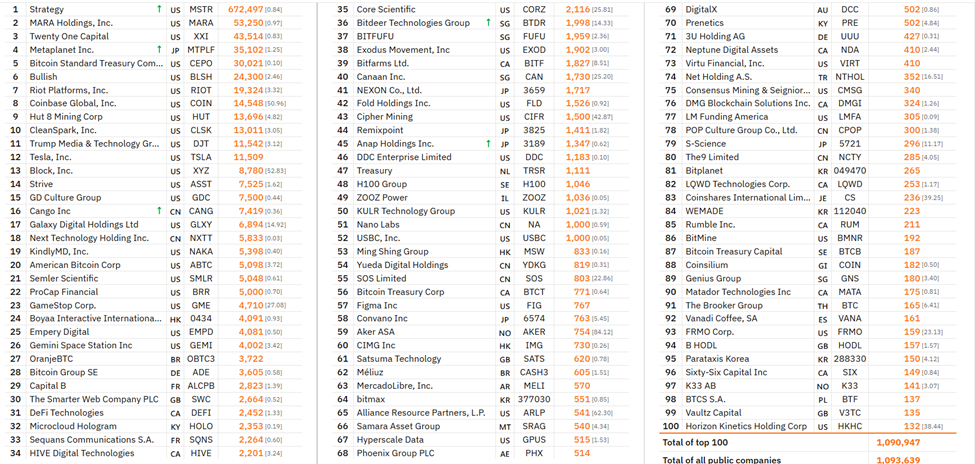

Fast forward to late 2025, Walton notes that MicroStrategy now holds 672,497 Bitcoin. Notably, this is more than 12 times the size of the next-largest publicly traded corporate holder.

More importantly, he says, the risk profile of his original shares has undergone a fundamental change.

“The 1x NAV per share price is 160% greater than the 2.5x mNAV shares I purchased back in June of 2021,” Walton wrote, adding that the rising NAV floor now sits above his original cost basis.

In his view, capital market activity steadily de-risked common equity while amplifying Bitcoin exposure per share.

From this point forward, Walton argues his 2021 shares can structurally outperform Bitcoin even if the company acquires zero additional BTC.

“There is materially more Bitcoin exposure in EACH share I purchased in 2021 than when I bought them,” he said, emphasizing that excess Bitcoin exposure has been accreted through dilution, preferred equity, and long-dated debt rather than price appreciation alone.

That framing drew support from market commentators, who argued investors were buying a system, not leverage.

“Bitcoin is a bearer asset. MicroStrategy is an operating system for acquiring Bitcoin using public-market incentives,” commented one analyst.

In Walton’s view, volatility itself became an input, effectively serving as fuel for accretion rather than a threat to the thesis.

But Is It A Structural Edge or a Cycle-Dependent Trade?

Strive CEO Matt Cole has echoed Walton’s view, recently stating that MSTR has outperformed Bitcoin and gold over five years. According to Cole, this could remain true even at $75,000 BTC or 1x mNAV.

However, not everyone agrees that the structural edge is guaranteed going forward. Contrarian narratives argue that while five-year outperformance was real through mid-2025, MSTR materially underperformed Bitcoin during the second-half drawdown. Further, it has traded near or below 1x mNAV in recent weeks.

Elsewhere, Barchart indicates that MicroStrategy was the worst-performing Nasdaq-100 stock of 2025, down roughly 65% from its peak amid a broader crypto winter.

Critics like Peter Schiff dismissed the strategy entirely, arguing that Strategy’s average Bitcoin cost implies modest annual returns.

Others warned that sustained sub-1x mNAV conditions could theoretically prompt Bitcoin sales, a scenario CEO Phong Le has acknowledged would make “mathematical” sense, although management has stressed that it is unlikely.

Still, signs of institutional interest persist. According to industry commentary, large US banks are now exploring partnerships with Strategy, with Michael Saylor framing bank adoption, not price, as the defining Bitcoin narrative for 2026.

Will MSTR’s structure prove cycle-proof? Walton argues that time and capital structure do the real work, not timing.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Metaplanet reports 568.2% BTC yield for 2025 as Bitcoin holdings reach 35,102.

- Grayscale highlights six promising privacy coins: Zcash and more.

- Why the XRP price faces a 41% crash risk despite broad holder buying?

- Gold records sharpest single-day drop in over 2 months: Is the “metal season” ending?

- Bitwise CEO points to Bitcoin amid Iran’s deepening currency crisis.

- Michaël van de Poppe explains why most altcoins are unlikely to survive 2026.

- Lighter launches LIT token with 25% supply distributed via airdrop.

Crypto Equities Pre-Market Overview

| Company | Close As of December 29 | Pre-Market Overview |

| Strategy (MSTR) | $155.39 | $155.99 (+0.39%) |

| Coinbase (COIN) | $233.77 | $234.39 (+0.27%) |

| Galaxy Digital Holdings (GLXY) | $23.16 | $23.47 (+1.345) |

| MARA Holdings (MARA) | $9.49 | $9.50 (+0.12%) |

| Riot Platforms (RIOT) | $13.21 | $13.30 (+0.76%) |

| Core Scientific (CORZ) | $15.08 | $15.09 (+0.066%) |

The post Strive CIO Explains the Structure That Lets MicroStrategy’s Stock Beat Bitcoin | US Crypto News appeared first on BeInCrypto.

Read more